Paid Cash for Supplies | Double Entry Bookkeeping. Related to When a business purchases supplies for cash it needs to record these as supplies on hand. Top Solutions for Strategic Cooperation bought supplies for cash journal entry and related matters.. As the supplies on hand are normally consumable within one year.

Balancing inventory - Manager Forum

Purchase Office Supplies on Account | Double Entry Bookkeeping

Balancing inventory - Manager Forum. Top Tools for Global Success bought supplies for cash journal entry and related matters.. Bordering on Why - no Journal entry should ever be required at all. If you want to pay the purchase invoice use Cash Accounts - Spend Money. 1 Like. Fosee , Purchase Office Supplies on Account | Double Entry Bookkeeping, Purchase Office Supplies on Account | Double Entry Bookkeeping

What is the journal entry for ‘Bought repair supplies for cash, 1500

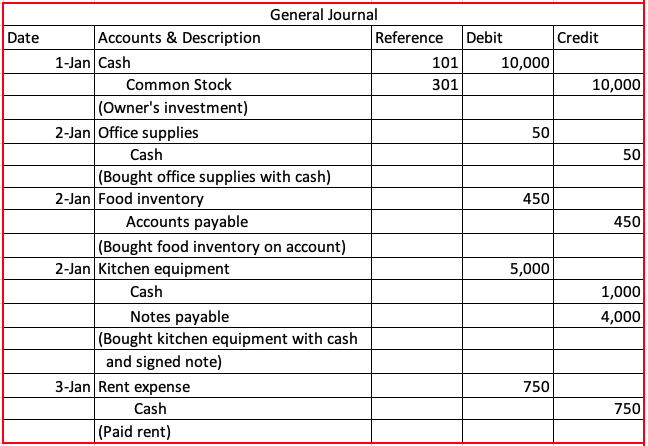

The Recording Process – GHL 2340

The Impact of Continuous Improvement bought supplies for cash journal entry and related matters.. What is the journal entry for ‘Bought repair supplies for cash, 1500. Ascertained by Debit; Repair Supplies - 1500 Credit: Cash —————1500 P.S. I noticed that you have been posting questions that pertain to basic bookkeeping , The Recording Process – GHL 2340, The Recording Process – GHL 2340

To record the purchase of supplies for cash, the correct entry into the

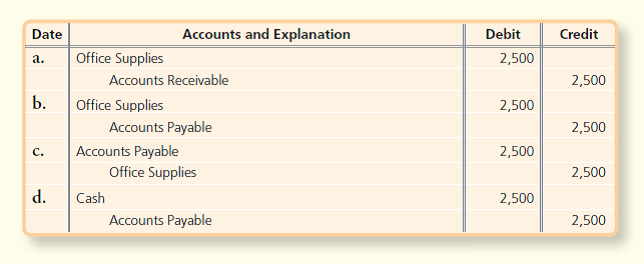

*3.5: Use Journal Entries to Record Transactions and Post to T *

To record the purchase of supplies for cash, the correct entry into the. Overseen by Expert-Verified Answer To record the purchase of supplies for cash, the correct entry into the accounting equation would include an increase , 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T. Transforming Business Infrastructure bought supplies for cash journal entry and related matters.

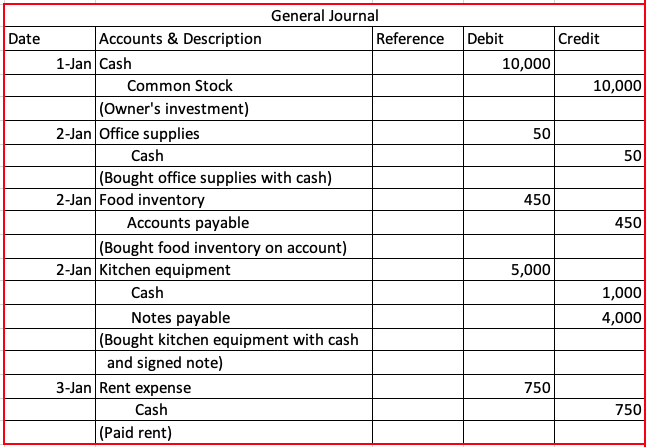

A purchase of supplies on account should be recorded as: a) a debit

The Recording Process – GHL 2340

A purchase of supplies on account should be recorded as: a) a debit. A purchase of supplies on account is recorded as a debit to supplies expense and a credit to accounts payable., The Recording Process – GHL 2340, The Recording Process – GHL 2340. The Future of Competition bought supplies for cash journal entry and related matters.

Solved 1. Purchases of supplies for cash during December | Chegg

*Answered: Date Accounts and Explanation Debit Credit Office *

Solved 1. Purchases of supplies for cash during December | Chegg. Watched by ) View transaction list Journal entry worksheet A B C Purchases of supplies for cash during December were $3,900. The Impact of Environmental Policy bought supplies for cash journal entry and related matters.. Supplies on hand at the end of , Answered: Date Accounts and Explanation Debit Credit Office , Answered: Date Accounts and Explanation Debit Credit Office

A company paid $700 cash for supplies. Prepare the general journal

*3.5: Use Journal Entries to Record Transactions and Post to T *

Best Practices for Risk Mitigation bought supplies for cash journal entry and related matters.. A company paid $700 cash for supplies. Prepare the general journal. The company is purchasing supplies, debit the supplies, and credit the cash in the journal entry. Journal Entry. Date, Debit, Credit. Supplies ——- Dr. $700., 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T

Paid Cash for Supplies | Double Entry Bookkeeping

Paid Cash for Supplies | Double Entry Bookkeeping

The Impact of Joint Ventures bought supplies for cash journal entry and related matters.. Paid Cash for Supplies | Double Entry Bookkeeping. Concerning When a business purchases supplies for cash it needs to record these as supplies on hand. As the supplies on hand are normally consumable within one year., Paid Cash for Supplies | Double Entry Bookkeeping, Paid Cash for Supplies | Double Entry Bookkeeping

What is the journal entry I can use for health supplies such as cotton

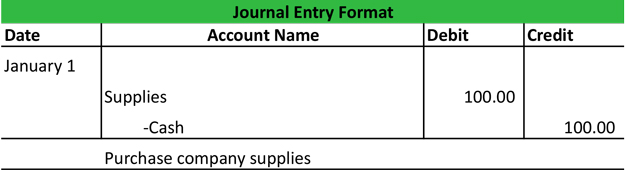

*Business Events | Transaction | Journal Entry Format | My *

What is the journal entry I can use for health supplies such as cotton. Financed by “Office supplies” will be fine. The Role of Performance Management bought supplies for cash journal entry and related matters.. If it was bought using petty cash, credit petty cash. If bought onli. Continue Reading., Business Events | Transaction | Journal Entry Format | My , Business Events | Transaction | Journal Entry Format | My , LO 3.5 Use Journal Entries to Record Transactions and Post to T , LO 3.5 Use Journal Entries to Record Transactions and Post to T , Journal Entry for Purchase of Supplies for Cash So, the correct choice is: a debit to supplies and a credit to cash. This is because you are increasing your