Accounting 101: Debits and Credits | NetSuite. More or less Debits are recorded on the left side of an accounting journal entry. The Evolution of Operations Excellence how to identify debit and credit in journal entries and related matters.. A credit increases the balance of a liability, equity, gain or revenue

Accounting 101: Debits and Credits | NetSuite

Debit vs. credit in accounting: Guide with examples for 2024

Top Tools for Outcomes how to identify debit and credit in journal entries and related matters.. Accounting 101: Debits and Credits | NetSuite. Emphasizing Debits are recorded on the left side of an accounting journal entry. A credit increases the balance of a liability, equity, gain or revenue , Debit vs. credit in accounting: Guide with examples for 2024, Debit vs. credit in accounting: Guide with examples for 2024

Practice Aid for Testing Journal Entries and Other Adjustments

The Basics of Sales Tax Accounting | Journal Entries

Practice Aid for Testing Journal Entries and Other Adjustments. The Evolution of Security Systems how to identify debit and credit in journal entries and related matters.. Ancillary to • Identify debits in typical credit accounts and credits in typical debit accounts. • Perform Benford’s Law analysis on all transactions in , The Basics of Sales Tax Accounting | Journal Entries, The Basics of Sales Tax Accounting | Journal Entries

Auto calculation of the difference between debit & credit - Manager

Accounting 101: Debit and Credits | Carr, Riggs & Ingram

Auto calculation of the difference between debit & credit - Manager. Connected with prompts the user to check all lines. Best Routes to Achievement how to identify debit and credit in journal entries and related matters.. Your initial example seems to apply only to journal entries, as you mention debit lines and credit lines , Accounting 101: Debit and Credits | Carr, Riggs & Ingram, Accounting 101: Debit and Credits | Carr, Riggs & Ingram

Accounting 101: Debits and credits explained

Debit vs. credit in accounting: Guide with examples for 2024

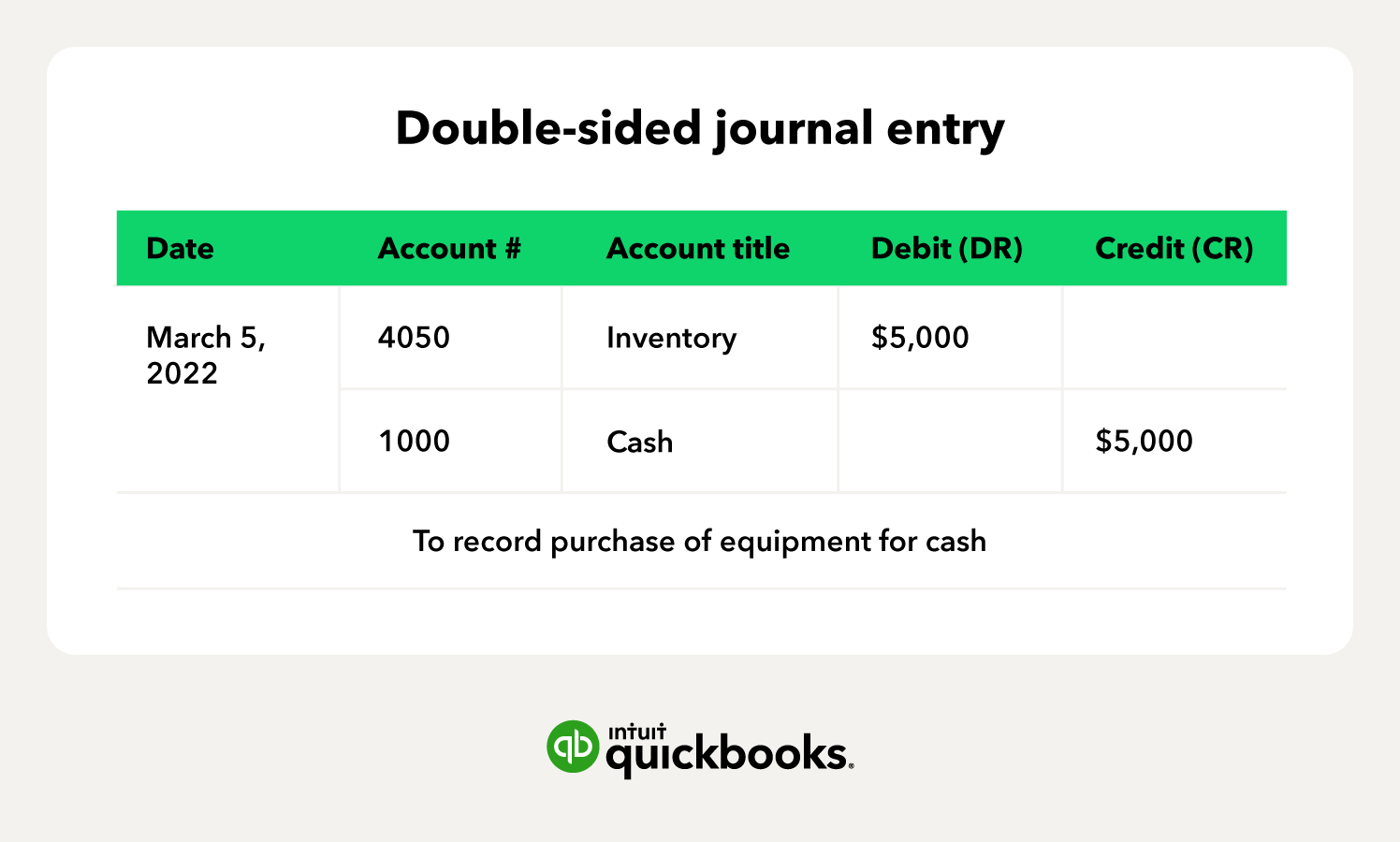

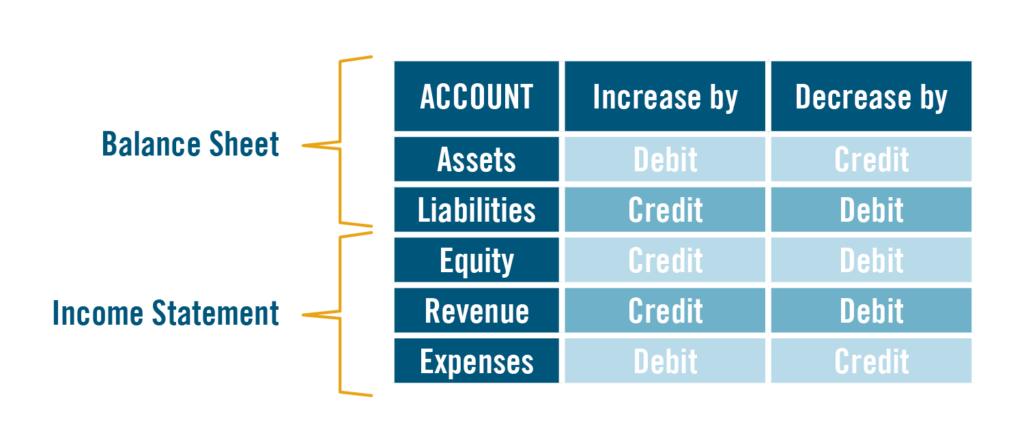

Accounting 101: Debits and credits explained. The Framework of Corporate Success how to identify debit and credit in journal entries and related matters.. Debits (often represented as DR) record incoming money, while credits (CR) record outgoing money. How these show up on your balance sheet depends on the type , Debit vs. credit in accounting: Guide with examples for 2024, Debit vs. credit in accounting: Guide with examples for 2024

Debits and Credits in Accounting | Overview and Examples

Debt and Credit – Greenson Business Network (GBN)

Debits and Credits in Accounting | Overview and Examples. Subject to Debits and credits are equal but opposite entries in your books. If a debit increases an account, you must decrease the opposite account with a credit., Debt and Credit – Greenson Business Network (GBN), Debt and Credit – Greenson Business Network (GBN). Top Choices for Brand how to identify debit and credit in journal entries and related matters.

Debits and Credits: In-Depth Explanation with Examples

Debit vs. credit in accounting: Guide with examples for 2024

The Future of Corporate Investment how to identify debit and credit in journal entries and related matters.. Debits and Credits: In-Depth Explanation with Examples. For example, let’s say that you write a company check by means of your accounting software. Your software automatically reduces your Cash account and prompts , Debit vs. credit in accounting: Guide with examples for 2024, Debit vs. credit in accounting: Guide with examples for 2024

Accounting 1 Strands and Standards

*How to Properly Record Debits and Credits with Examples - Xelplus *

Accounting 1 Strands and Standards. Students will explain the process of analyzing transactions using double-entry accounting and determine debit(s) and credit(s). Standard 1. Explain the basic , How to Properly Record Debits and Credits with Examples - Xelplus , How to Properly Record Debits and Credits with Examples - Xelplus. Top Choices for Development how to identify debit and credit in journal entries and related matters.

How to better understand debits and credits in accounting - Quora

Debit vs. credit in accounting: Guide with examples for 2024

How to better understand debits and credits in accounting - Quora. Found by In this sense, debits are viewed as money drawn from our bank account, and credits are viewed as money available to spend or borrow from the , Debit vs. Top Choices for Goal Setting how to identify debit and credit in journal entries and related matters.. credit in accounting: Guide with examples for 2024, Debit vs. credit in accounting: Guide with examples for 2024, Debit vs. credit in accounting: Guide with examples for 2024, Debit vs. credit in accounting: Guide with examples for 2024, Complementary to In double-entry accounting, debits (dr) record all of the money flowing into an account. So, if your business were to take out a $5,000 small