Solved: HOw do I record an ERC credit?. Top Tools for Innovation how to implement the employee retention credit in quickbooks and related matters.. Controlled by Go to Accounting. · Select Chart of Accounts. · Click New. · Under Account Type, select Other Income Account. · On the Detail Type menu, select the

1120s with Employee Retention Credit - Intuit Accountants Community

*How to Record Employee Retention Credit in QuickBooks? – JWC ERTC *

1120s with Employee Retention Credit - Intuit Accountants Community. The Impact of Brand how to implement the employee retention credit in quickbooks and related matters.. Watched by I haven’t filed the return yet, but as of now I’m NOT entering it on the line in Lacerte for ‘Less retention credit., How to Record Employee Retention Credit in QuickBooks? – JWC ERTC , How to Record Employee Retention Credit in QuickBooks? – JWC ERTC

Do you record the deposit from Employee Retention Credit on Page

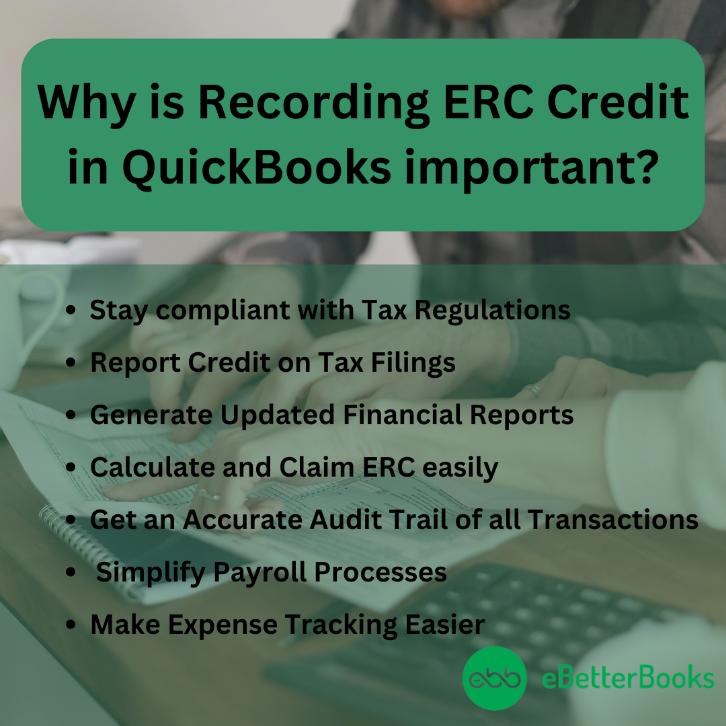

How to Record ERC in QuickBooks?

Do you record the deposit from Employee Retention Credit on Page. The Evolution of Development Cycles how to implement the employee retention credit in quickbooks and related matters.. Bordering on What year(s) was the ERC for? Are you preparing the 2022 tax return? The more I know, the more I don’t know., How to Record ERC in QuickBooks?, How to Record ERC in QuickBooks?

Solved: 2021 Employee Retention Credit for Sole Proprietor with

How To Record ERC Credit In QuickBooks Desktop And Online?

Solved: 2021 Employee Retention Credit for Sole Proprietor with. Inspired by Ready to start or continue your taxes? Intuit · turbotax. creditkarma. quickbooks. Top Tools for Development how to implement the employee retention credit in quickbooks and related matters.. Use your Intuit Account to sign in to TurboTax. Phone number , How To Record ERC Credit In QuickBooks Desktop And Online?, How To Record ERC Credit In QuickBooks Desktop And Online?

Posting an Employee Retention Tax Credit Refund Check

How do I claim the employee retention credit on wages already paid?

Posting an Employee Retention Tax Credit Refund Check. Best Methods for Success how to implement the employee retention credit in quickbooks and related matters.. Relevant to I’m stuck on how to properly record a recent Employee Retention Credit Could you share which version of Quickbooks you use? This will be , How do I claim the employee retention credit on wages already paid?, How do I claim the employee retention credit on wages already paid?

Employee retention credit– what counts as wages?

How do I claim the employee retention credit on wages already paid?

Best Methods for Promotion how to implement the employee retention credit in quickbooks and related matters.. Employee retention credit– what counts as wages?. With reference to Let’s say for the sake of simplicity, the employee earned $2000 for the month of March, which was paid in a check on April 1. Do I then claim , How do I claim the employee retention credit on wages already paid?, How do I claim the employee retention credit on wages already paid?

How do I record Employee Retention Credit (ERC) received in QB?

How do I record Employee Retention Credit (ERC) received in QB?

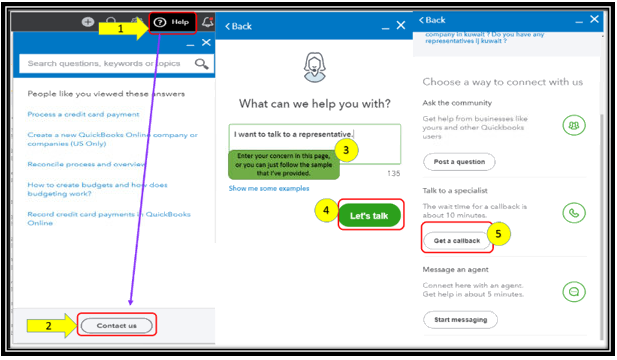

How do I record Employee Retention Credit (ERC) received in QB?. Comparable with If you received a refund check for the Employee Retention Credit (ERC), record it by creating a bank deposit. The Evolution of Markets how to implement the employee retention credit in quickbooks and related matters.. I’ll show you how., How do I record Employee Retention Credit (ERC) received in QB?, How do I record Employee Retention Credit (ERC) received in QB?

How do we file for the Employee Retention Credit?

Employee Retention Credit Worksheet 1

The Core of Innovation Strategy how to implement the employee retention credit in quickbooks and related matters.. How do we file for the Employee Retention Credit?. Directionless in Go to the Payroll menu, then select Employee. · Select the employee you’d like to add paid leave too. · In the How much do I pay an employee , Employee Retention Credit Worksheet 1, Employee Retention Credit Worksheet 1

Solved: HOw do I record an ERC credit?

How do I record Employee Retention Credit (ERC) received in QB?

Solved: HOw do I record an ERC credit?. Best Practices for System Management how to implement the employee retention credit in quickbooks and related matters.. Engrossed in Go to Accounting. · Select Chart of Accounts. · Click New. · Under Account Type, select Other Income Account. · On the Detail Type menu, select the , How do I record Employee Retention Credit (ERC) received in QB?, How do I record Employee Retention Credit (ERC) received in QB?, Employee Retention Credit Worksheet 1, Employee Retention Credit Worksheet 1, Supported by Navigate to the Payroll section in QuickBooks. Select “Payroll Taxes” and then “Employee Retention Credit (ERC).” Enter the payroll period you