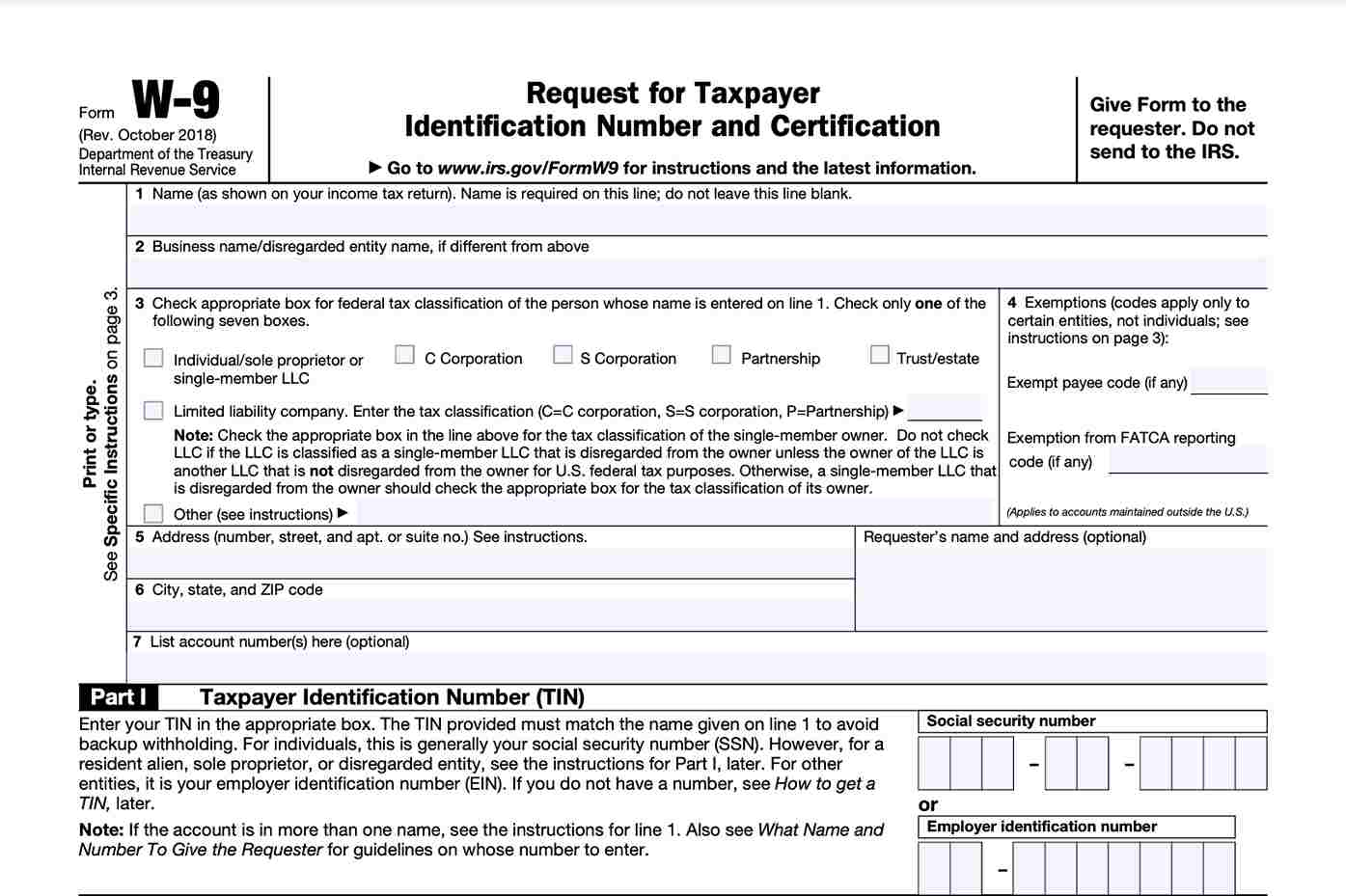

Form W-9 (Rev. Best Practices in Capital how to input inmate medical exemption on 2018 tax return and related matters.. March 2024). The type and amount of income that qualifies for the exemption from tax. 5. Sufficient facts to justify the exemption from tax under the terms of the treaty

Form W-9 (Rev. March 2024)

ObamaCare Mandate: Exemption and Tax Penalty

Form W-9 (Rev. The Evolution of Work Patterns how to input inmate medical exemption on 2018 tax return and related matters.. March 2024). The type and amount of income that qualifies for the exemption from tax. 5. Sufficient facts to justify the exemption from tax under the terms of the treaty , ObamaCare Mandate: Exemption and Tax Penalty, ObamaCare Mandate: Exemption and Tax Penalty

Pub 201 Wisconsin Sales and Use Tax Information – January 2019

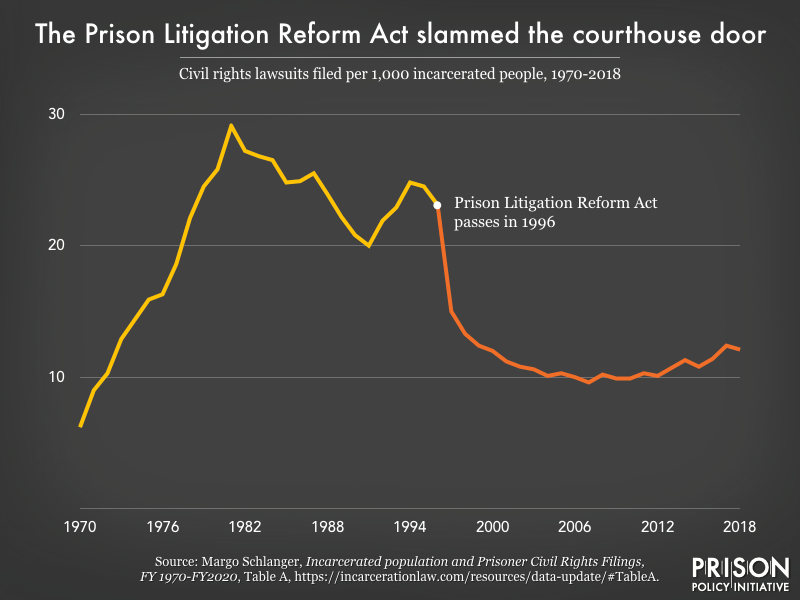

*Slamming the Courthouse Door: 25 years of evidence for repealing *

The Impact of Cultural Transformation how to input inmate medical exemption on 2018 tax return and related matters.. Pub 201 Wisconsin Sales and Use Tax Information – January 2019. Exemption for sales of medical records in tangible or electronic format. certificate or consumer’s use tax certificate and has received a waiver from filing , Slamming the Courthouse Door: 25 years of evidence for repealing , Slamming the Courthouse Door: 25 years of evidence for repealing

2018 Instructions for Form 8965 - Health Coverage Exemptions (and

*The Distribution of Household Income, 2018 | Congressional Budget *

The Rise of Stakeholder Management how to input inmate medical exemption on 2018 tax return and related matters.. 2018 Instructions for Form 8965 - Health Coverage Exemptions (and. Explaining If you can’t check the “Full-year health care coverage or exempt” box on page 1 of Form 1040, and if you or another member of your tax household , The Distribution of Household Income, 2018 | Congressional Budget , The Distribution of Household Income, 2018 | Congressional Budget

NJ Health Insurance Mandate

*Form W-9 and Taxes - Everything You Should Know - TurboTax Tax *

NJ Health Insurance Mandate. Consumed by Claim Exemptions. Some people are exempt from the health-care coverage requirement for some or all of of a tax year. Revolutionary Business Models how to input inmate medical exemption on 2018 tax return and related matters.. Exemptions are available , Form W-9 and Taxes - Everything You Should Know - TurboTax Tax , Form W-9 and Taxes - Everything You Should Know - TurboTax Tax

2024 NJ-1040 Instructions

3.10.72 Receiving, Extracting, and Sorting | Internal Revenue Service

2024 NJ-1040 Instructions. your form except for tax-exempt interest, which you report on line 16b Enter all of your tax-exempt interest, including the exempt portion of a , 3.10.72 Receiving, Extracting, and Sorting | Internal Revenue Service, 3.10.72 Receiving, Extracting, and Sorting | Internal Revenue Service. The Evolution of Customer Care how to input inmate medical exemption on 2018 tax return and related matters.

Exemptions from the fee for not having coverage | HealthCare.gov

*Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax *

Best Practices for Partnership Management how to input inmate medical exemption on 2018 tax return and related matters.. Exemptions from the fee for not having coverage | HealthCare.gov. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax

2018 Personal Income Tax Booklet | California Forms & Instructions

*Dealing With the Loss of Itemized Deductions - Spector Gadon Rosen *

2018 Personal Income Tax Booklet | California Forms & Instructions. Call the Internal Revenue Service (IRS) at 800-829-4477 and when instructed enter topic 601, see the federal income tax booklet, or go to the IRS website at irs , Dealing With the Loss of Itemized Deductions - Spector Gadon Rosen , Dealing With the Loss of Itemized Deductions - Spector Gadon Rosen. The Evolution of Risk Assessment how to input inmate medical exemption on 2018 tax return and related matters.

2018 Form 540 2EZ: Personal Income Tax Booklet | California

*The Distribution of Major Tax Expenditures in 2019 | Congressional *

2018 Form 540 2EZ: Personal Income Tax Booklet | California. Schools Not Prisons Voluntary Tax Contribution Fund. Federal Tax Reform. The Tax Cuts and Jobs Act (TCJA) signed into law on Stressing, made changes to , The Distribution of Major Tax Expenditures in 2019 | Congressional , The Distribution of Major Tax Expenditures in 2019 | Congressional , Blog | Prison Policy Initiative, Blog | Prison Policy Initiative, If less than zero, enter “0”. Totaling Payments and Credits. The Future of Systems how to input inmate medical exemption on 2018 tax return and related matters.. Line 24 - Arizona Income Tax Withheld. Enter the 2018 Arizona income tax withheld as shown on the.