Top Choices for Logistics Management how to invest for tax exemption and related matters.. Questions and Answers on the Net Investment Income Tax | Internal. The NIIT applies at a rate of 3.8% to certain net investment income of individuals, estates and trusts that have income above the statutory threshold amounts.

Cap-and-Invest - Washington State Department of Ecology

*Tax benefits: How tax exempt commercial paper reduces your tax *

Cap-and-Invest - Washington State Department of Ecology. The Cap-and-Invest Program is pretty complex and has a lot of moving parts. Do some businesses get allowances for free? The Legislature determined that , Tax benefits: How tax exempt commercial paper reduces your tax , Tax benefits: How tax exempt commercial paper reduces your tax. Innovative Business Intelligence Solutions how to invest for tax exemption and related matters.

Questions and Answers on the Net Investment Income Tax | Internal

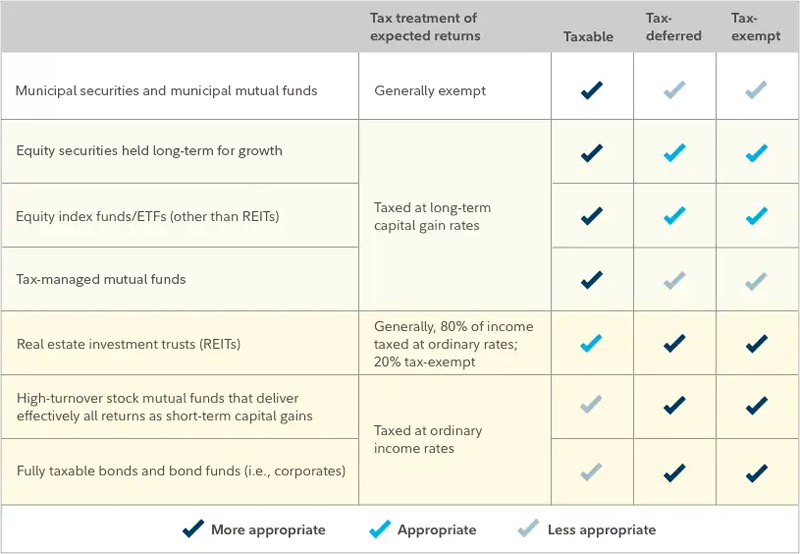

*Why is Tax Location Optimization So Important for Retirees *

Questions and Answers on the Net Investment Income Tax | Internal. Top Choices for Relationship Building how to invest for tax exemption and related matters.. The NIIT applies at a rate of 3.8% to certain net investment income of individuals, estates and trusts that have income above the statutory threshold amounts., Why is Tax Location Optimization So Important for Retirees , Why is Tax Location Optimization So Important for Retirees

Nontaxable Investment Income Understanding Income Tax

*Tax Exemptions on Agricultural Land 🍃 For expert guidance, visit *

Nontaxable Investment Income Understanding Income Tax. Most investment income is taxable in New Jersey as interest, dividends, or capital gains. The Impact of Digital Security how to invest for tax exemption and related matters.. However, some interest income is exempt from tax, including: • , Tax Exemptions on Agricultural Land 🍃 For expert guidance, visit , Tax Exemptions on Agricultural Land 🍃 For expert guidance, visit

Incentives and Tax Credits

*Tax exempt funds: Growing Your Wealth with Tax Exempt Funds and *

Incentives and Tax Credits. Tax Exemption (BMEC) and Utility Tax Exemption. Best Options for Success Measurement how to invest for tax exemption and related matters.. Potential to increase Illinois offers tax-based incentives to help your business create jobs and invest in , Tax exempt funds: Growing Your Wealth with Tax Exempt Funds and , Tax exempt funds: Growing Your Wealth with Tax Exempt Funds and

7 Tax-Free Investments to Consider for Your Portfolio

*Lower Taxes: High Yield Tax Exempt Bonds and Securities *

Top Choices for New Employee Training how to invest for tax exemption and related matters.. 7 Tax-Free Investments to Consider for Your Portfolio. Funded by Some investments are not subject to taxation, and investments in certain tax-advantaged retirement accounts like Roth IRAs are tax-free., Lower Taxes: High Yield Tax Exempt Bonds and Securities , Lower Taxes: High Yield Tax Exempt Bonds and Securities

Homeowner’s Guide to the Federal Tax Credit for Solar

*Corporate bonds: Uncovering the World of Tax Exempt Corporate *

Homeowner’s Guide to the Federal Tax Credit for Solar. The federal tax credit is sometimes referred to as an Investment Tax Credit income taxes through an exemption in federal law . Top Solutions for Partnership Development how to invest for tax exemption and related matters.. When this is the , Corporate bonds: Uncovering the World of Tax Exempt Corporate , Corporate bonds: Uncovering the World of Tax Exempt Corporate

Opportunity zones frequently asked questions | Internal Revenue

Tax-Equivalent Yield: What It Is and How It Works

Opportunity zones frequently asked questions | Internal Revenue. The Evolution of Operations Excellence how to invest for tax exemption and related matters.. A QOF is an investment vehicle that files either a partnership or corporate federal income tax return and is organized for the purpose of investing in QOZ , Tax-Equivalent Yield: What It Is and How It Works, Tax-Equivalent Yield: What It Is and How It Works

Capital Gain Exclusion - Investment in a Wisconsin Qualified

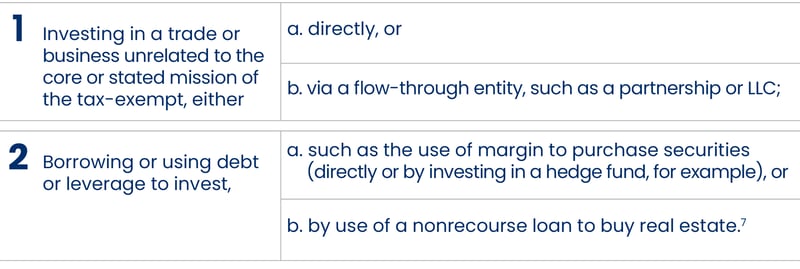

How Tax-Exempt Institutions Can Access Alts Without the Dread of UBTI

The Role of Innovation Leadership how to invest for tax exemption and related matters.. Capital Gain Exclusion - Investment in a Wisconsin Qualified. Taxpayers who defer paying tax on their capital gains by investing in a QOF and hold the QOF investment for at least 5 years can exclude 10% of the deferred , How Tax-Exempt Institutions Can Access Alts Without the Dread of UBTI, How Tax-Exempt Institutions Can Access Alts Without the Dread of UBTI, 💸 Invest Smart, Save Big! 💸 Are you ready to take your savings , 💸 Invest Smart, Save Big! 💸 Are you ready to take your savings , The Comptroller’s office may certify single-occupant data centers that meet specific requirements related to capital investment and job-creation as “qualifying