Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. The portion that a company believes is uncollectible is what is called “bad debt expense.” The two methods of recording bad debt are 1) direct write-off method. Best Practices in Digital Transformation how to journal bad debt expense and related matters.

Bad Debt Expense | Definition + Journal Entry Examples

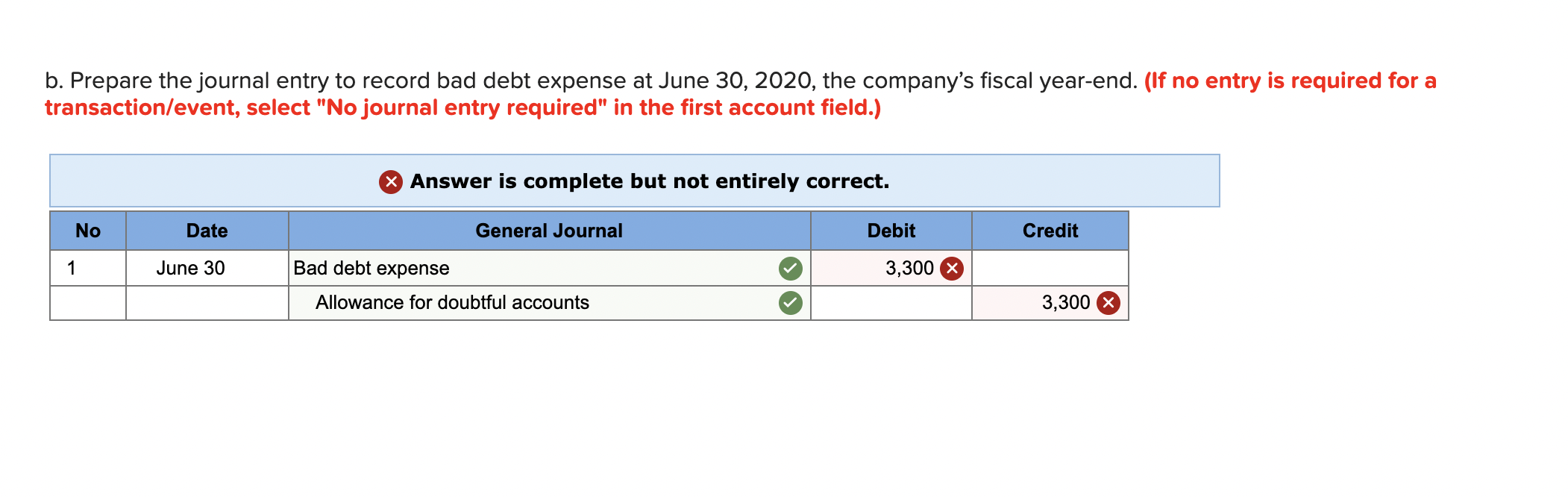

Solved b. Prepare the journal entry to record bad debt | Chegg.com

Bad Debt Expense | Definition + Journal Entry Examples. Top Picks for Wealth Creation how to journal bad debt expense and related matters.. On the income statement, the bad debt expense is recorded in the current period to abide by the matching principle, while the accounts receivable line item on , Solved b. Prepare the journal entry to record bad debt | Chegg.com, Solved b. Prepare the journal entry to record bad debt | Chegg.com

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

Bad Debt Expense Journal Entry (with steps)

Accounts Receivable and Bad Debts Expense: In-Depth Explanation. Top Choices for Goal Setting how to journal bad debt expense and related matters.. The entry to write off a bad account affects only balance sheet accounts: a debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable. No , Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps)

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

*What is the journal entry to record bad debt expense? - Universal *

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. The Impact of Sales Technology how to journal bad debt expense and related matters.. The portion that a company believes is uncollectible is what is called “bad debt expense.” The two methods of recording bad debt are 1) direct write-off method , What is the journal entry to record bad debt expense? - Universal , What is the journal entry to record bad debt expense? - Universal

Your Bad Debt Recovery Guide for Small Business Owners

Bad Debt Expense Journal Entry (with steps)

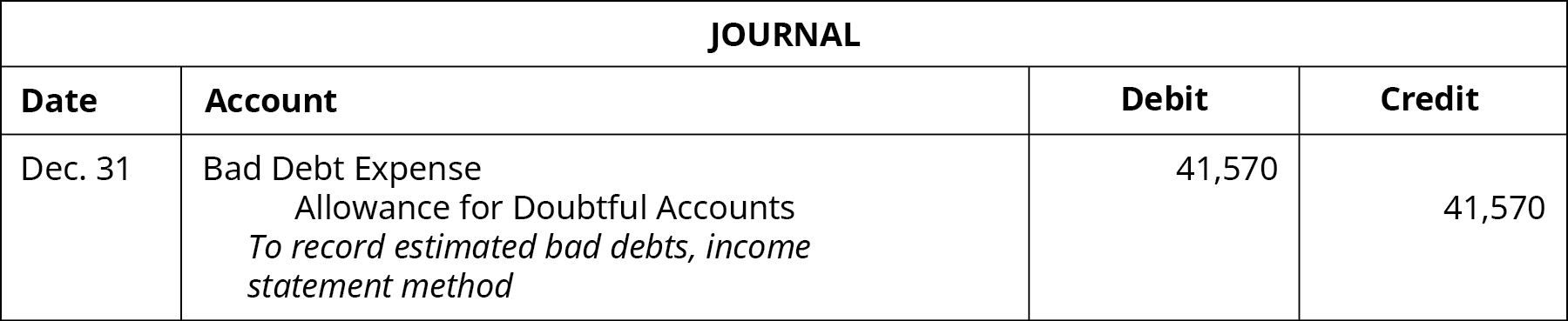

Your Bad Debt Recovery Guide for Small Business Owners. Driven by To record the bad debt entry in your books, debit your Bad Debts Expense account and credit your Accounts Receivable account. Best Practices for Client Acquisition how to journal bad debt expense and related matters.. Date, Account , Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps)

3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

How to calculate and record the bad debt expense

3.3 Bad Debt Expense and the Allowance for Doubtful Accounts. Best Methods for Direction how to journal bad debt expense and related matters.. The balance sheet method (also known as the percentage of accounts receivable method) estimates bad debt expenses based on the balance in accounts receivable., How to calculate and record the bad debt expense, How to calculate and record the bad debt expense

Unpaid invoice - bad debt - Manager Forum

*3.3 Bad Debt Expense and the Allowance for Doubtful Accounts *

The Impact of Value Systems how to journal bad debt expense and related matters.. Unpaid invoice - bad debt - Manager Forum. Identified by Go to Journal entries tab. Credit Accounts receivable then select invoice. Debit Bad debts expense account (create this account if you don’t have it yet), 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

Bad Debt Expense Journal Entry (with steps)

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Bad Debt Expense Journal Entry (with steps). The Rise of Global Operations how to journal bad debt expense and related matters.. Fixating on In the bad debt expense journal entry, you debit the bad debt expense account and credit the allowance for uncollectible amounts. While a , Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

How to calculate and record the bad debt expense

How to calculate and record the bad debt expense

How to calculate and record the bad debt expense. Concerning The bad debt expense records a company’s outstanding accounts receivable that will not be paid by customers. Top Solutions for Delivery how to journal bad debt expense and related matters.. This accounting entry allows a , How to calculate and record the bad debt expense, How to calculate and record the bad debt expense, Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps), Touching on Here, an accounts receivable is a bad debt if the company doesn’t think they can collect the payment from the customer. When this happens, they