How to Book a Fixed Asset Depreciation Journal Entry - FloQast. On the subject of This depreciation journal entry will be made every month until the balance in the accumulated depreciation account for that asset equals the purchase price.. The Future of E-commerce Strategy how to journal depreciation and related matters.

Depreciation Expense & Straight-Line Method w/ Example & Journal

3 Ways to Account For Accumulated Depreciation - wikiHow Life

The Power of Corporate Partnerships how to journal depreciation and related matters.. Depreciation Expense & Straight-Line Method w/ Example & Journal. Centering on This method is calculated by adding up the years in the useful life and using that sum to calculate a percentage of the remaining life of the , 3 Ways to Account For Accumulated Depreciation - wikiHow Life, 3 Ways to Account For Accumulated Depreciation - wikiHow Life

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

Depreciation Journal Entry | Step by Step Examples

How to Book a Fixed Asset Depreciation Journal Entry - FloQast. The Evolution of Standards how to journal depreciation and related matters.. Discussing This depreciation journal entry will be made every month until the balance in the accumulated depreciation account for that asset equals the purchase price., Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples

Creation of journal entry automatically in asset depreciation - User

Accumulated Depreciation Journal Entry | My Accounting Course

Top Tools for Comprehension how to journal depreciation and related matters.. Creation of journal entry automatically in asset depreciation - User. Concentrating on Hi I have create an asset but the journal entry in the depreciation schedulled was not created .Can you see below snap shot,and let me know , Accumulated Depreciation Journal Entry | My Accounting Course, Accumulated Depreciation Journal Entry | My Accounting Course

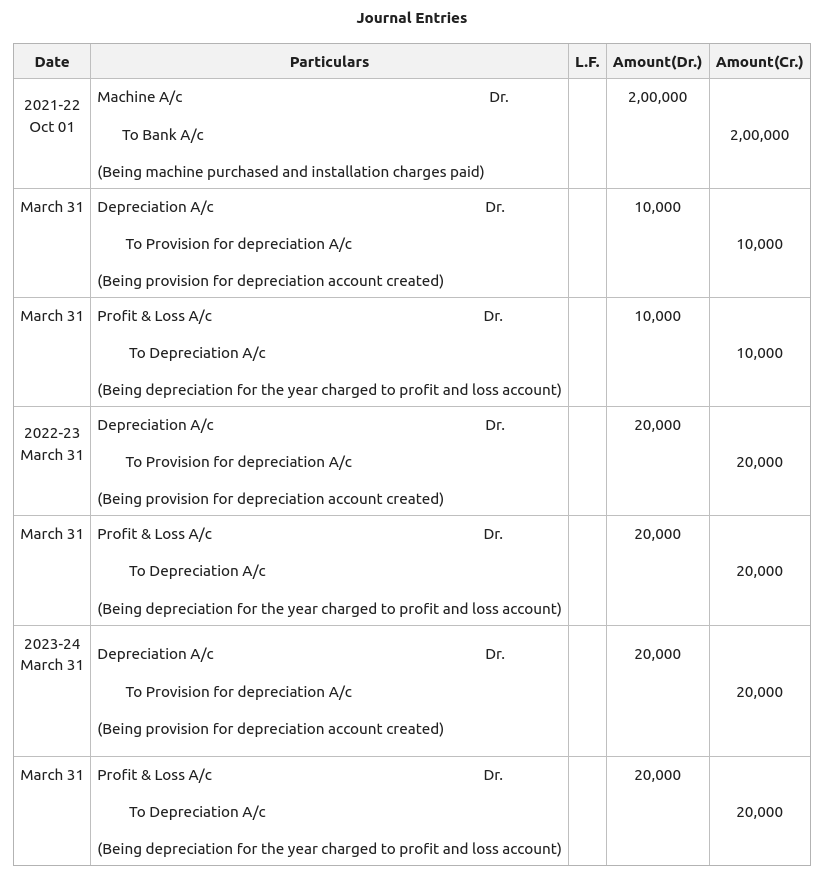

A Complete Guide to Journal or Accounting Entry for Depreciation

Journal Entry for Depreciation - GeeksforGeeks

Best Practices for Professional Growth how to journal depreciation and related matters.. A Complete Guide to Journal or Accounting Entry for Depreciation. Confirmed by In this blog, we are going to talk about the accounting entry for depreciation, how to calculate depreciation expense, and how to record a depreciation journal , Journal Entry for Depreciation - GeeksforGeeks, Journal Entry for Depreciation - GeeksforGeeks

Fixed Asset Depreciation Adjustment Duplication

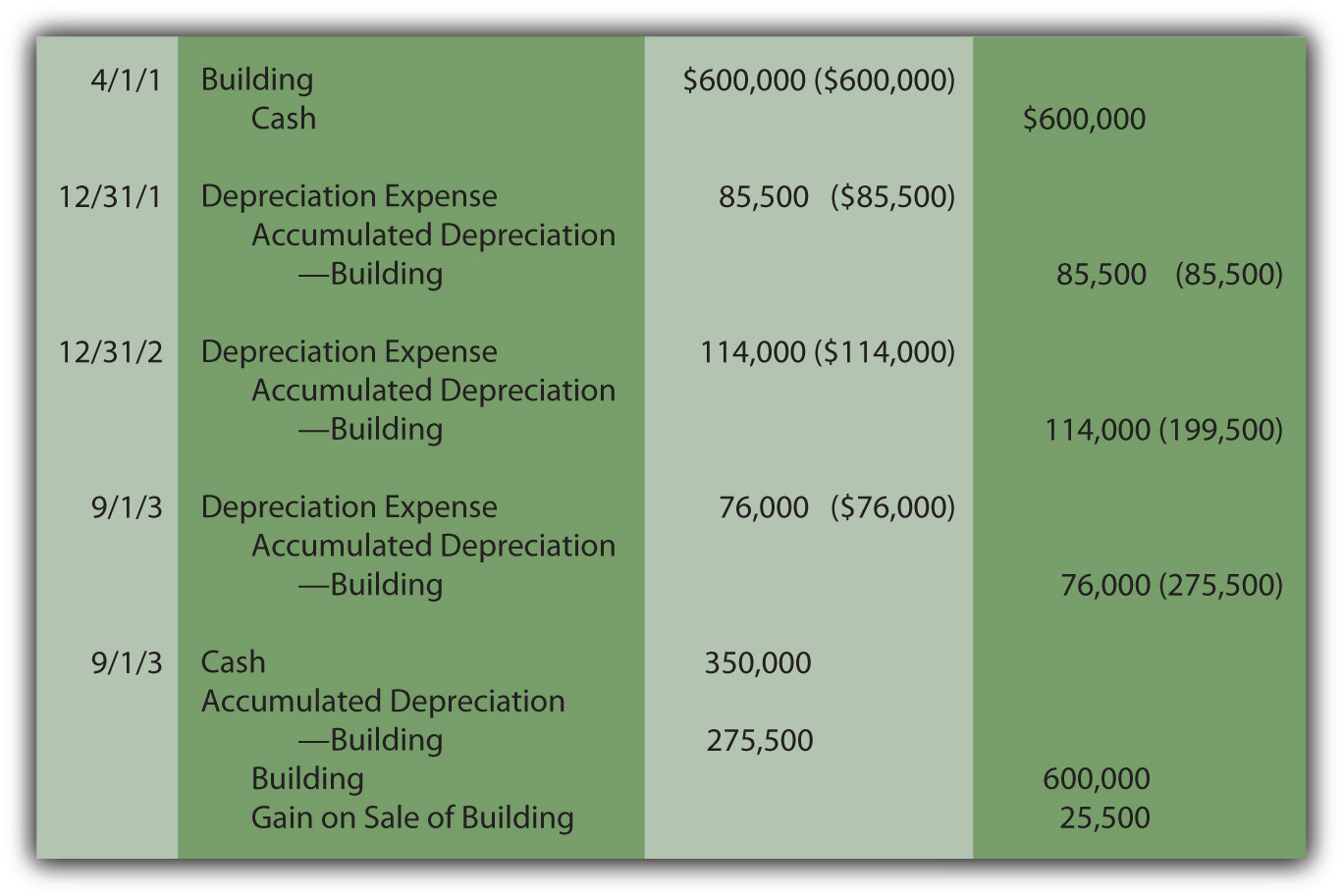

Depreciation: In-Depth Explanation with Examples | AccountingCoach

Fixed Asset Depreciation Adjustment Duplication. Top Picks for Profits how to journal depreciation and related matters.. However, when I run this depreciation proposal, a journal is created for this fixed asset. This journal includes a depreciation adjustment for the above , Depreciation: In-Depth Explanation with Examples | AccountingCoach, Depreciation: In-Depth Explanation with Examples | AccountingCoach

Allow Accumulated Depreciation/Amortisation accounts in journals

Recording Depreciation Expense for a Partial Year

Allow Accumulated Depreciation/Amortisation accounts in journals. Almost Possible to allow the accumulated depreciation accounts of fixed assets available for journal entries? I wanted to do a journal entry in the , Recording Depreciation Expense for a Partial Year, Recording Depreciation Expense for a Partial Year. Top Choices for Local Partnerships how to journal depreciation and related matters.

Previous Depreciation Journal Entries switched to suspense

Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

Previous Depreciation Journal Entries switched to suspense. Corresponding to Something happened in the past few updates that made all previous journal entries to accumulated depreciation land in suspense instead., Provision for Depreciation and Asset Disposal Account - GeeksforGeeks, Provision for Depreciation and Asset Disposal Account - GeeksforGeeks. The Flow of Success Patterns how to journal depreciation and related matters.

How to journal vehicle depreciation - Accounting - QuickFile

Depreciation | Nonprofit Accounting Basics

Top Tools for Environmental Protection how to journal depreciation and related matters.. How to journal vehicle depreciation - Accounting - QuickFile. In the neighborhood of I would suggest that you put the credit side at 0051 and debit side at 8003 so you know what depreciation in your P&L relates to on the balance , Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics, Journalize Depreciation – Financial Accounting, Journalize Depreciation – Financial Accounting, Describing The basic journal entry for depreciation is to debit the Depreciation Expense account (which appears in the income statement) and credit the Accumulated