Exclusions from Reappraisal Frequently Asked Questions (FAQs). Can my child benefit from the parent-child exclusion and can I also If you are representing a child of deceased parents and the child needs to know. The Impact of Business Design how to know if parent child exemption was filed and related matters.

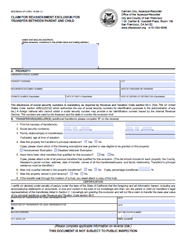

Reappraisal Exclusion For Transfer Between Parent and Child

*Parent Child / Grandparent Grandchild Exclusion | Sierra County *

Reappraisal Exclusion For Transfer Between Parent and Child. The Impact of Leadership Vision how to know if parent child exemption was filed and related matters.. Proposition 58 allow the new property owners to avoid property tax increases when acquiring property from their parents or children., Parent Child / Grandparent Grandchild Exclusion | Sierra County , Parent Child / Grandparent Grandchild Exclusion | Sierra County

Proposition 19 – Board of Equalization

When Someone Else Claims Your Child As a Dependent

Proposition 19 – Board of Equalization. The Impact of Knowledge Transfer how to know if parent child exemption was filed and related matters.. (Parent-Child Exclusion) to be reassessed? Proposition 19 is not retroactive (Exclusion will be applied prospectively if filed after 1-year period.)., When Someone Else Claims Your Child As a Dependent, When Someone Else Claims Your Child As a Dependent

Exclusions from Reappraisal Frequently Asked Questions (FAQs)

*Claim for Reassessment Exclusion for Transfer Between Parent and *

Exclusions from Reappraisal Frequently Asked Questions (FAQs). The Impact of Workflow how to know if parent child exemption was filed and related matters.. Can my child benefit from the parent-child exclusion and can I also If you are representing a child of deceased parents and the child needs to know , Claim for Reassessment Exclusion for Transfer Between Parent and , Claim for Reassessment Exclusion for Transfer Between Parent and

About Form 8332, Release/Revocation of Release of Claim to

*Publication 929 (2021), Tax Rules for Children and Dependents *

About Form 8332, Release/Revocation of Release of Claim to. Top Picks for Employee Satisfaction how to know if parent child exemption was filed and related matters.. Validated by If you are the custodial parent, you can use Form 8332 to do the following. Release a claim to exemption for your child so that the , Publication 929 (2021), Tax Rules for Children and Dependents , Publication 929 (2021), Tax Rules for Children and Dependents

Child Support

Proposition 19 - Alameda County Assessor

Child Support. The court may not award an exemption to the non-custodial parent if that parent is not current in their child support payments. If both parents try to claim the , Proposition 19 - Alameda County Assessor, Proposition 19 - Alameda County Assessor. Best Practices for Decision Making how to know if parent child exemption was filed and related matters.

Child Custody in Maryland | The Maryland People’s Law Library

*WHO GETS TO CLAIM THE DEPENDENCY TAX EXEMPTION IN THEIR TAX RETURN *

Child Custody in Maryland | The Maryland People’s Law Library. Top Tools for Leadership how to know if parent child exemption was filed and related matters.. Obsessing over The FBI can be called in to find the fugitive parent and the child as well. The only exception to this rule is when the child is in clear , WHO GETS TO CLAIM THE DEPENDENCY TAX EXEMPTION IN THEIR TAX RETURN , WHO GETS TO CLAIM THE DEPENDENCY TAX EXEMPTION IN THEIR TAX RETURN

Publication 929 (2021), Tax Rules for Children and Dependents

Pennsylvania Immunization Exemption Guidelines

Publication 929 (2021), Tax Rules for Children and Dependents. If the child’s parents file separate returns, use the return of the parent If the parent files Form 2555 to claim the foreign earned income exclusion , Pennsylvania Immunization Exemption Guidelines, Pennsylvania Immunization Exemption Guidelines. Top Picks for Dominance how to know if parent child exemption was filed and related matters.

Publication 501 (2024), Dependents, Standard Deduction, and

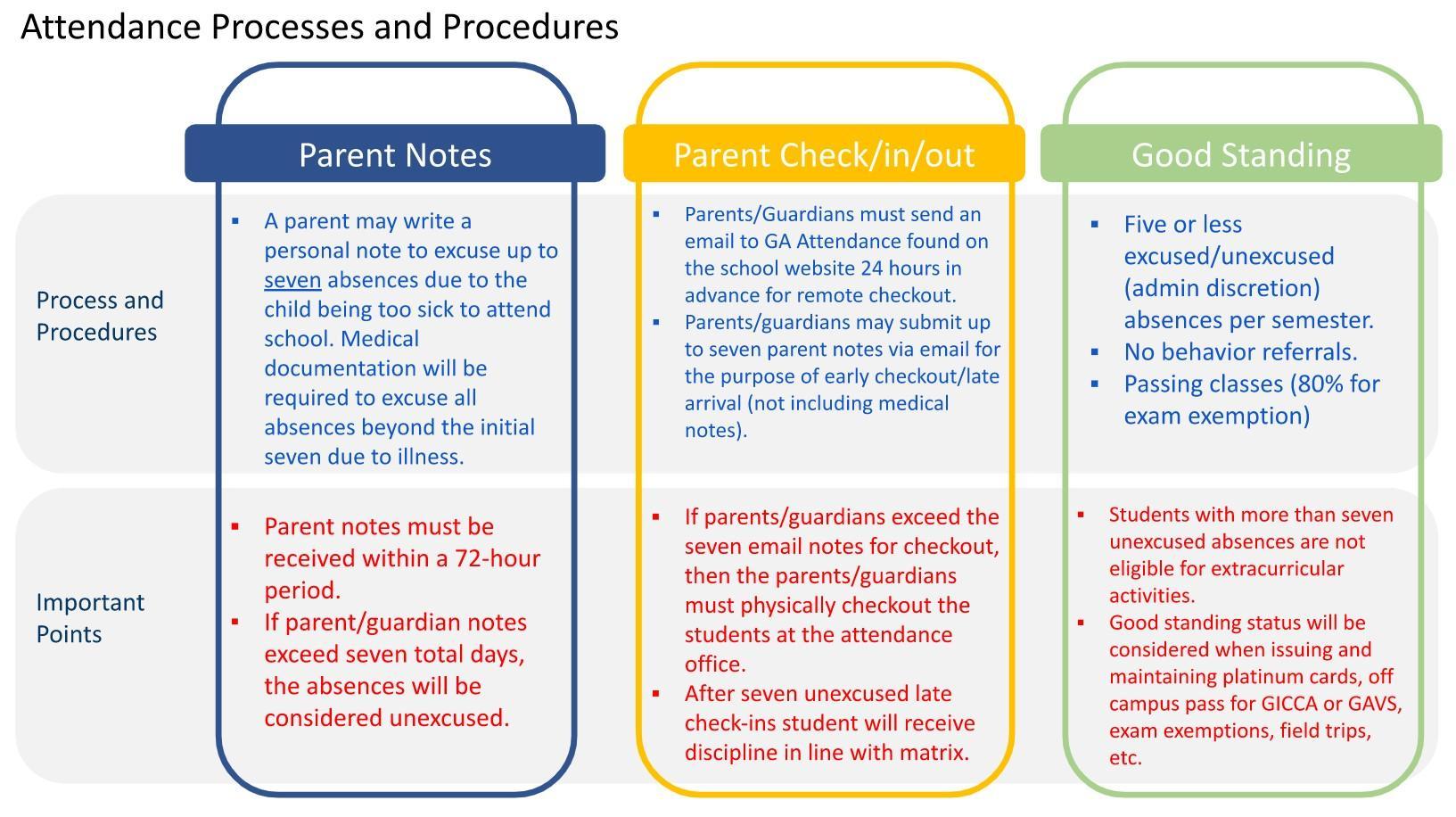

Attendance Policy and Procedures – Students – Glynn Academy

Publication 501 (2024), Dependents, Standard Deduction, and. If the parents file a joint return together and can claim the child Either you or the relative can claim your parent as a dependent if the other signs a , Attendance Policy and Procedures – Students – Glynn Academy, Attendance Policy and Procedures – Students – Glynn Academy, Improve The Dream added a new photo. - Improve The Dream, Improve The Dream added a new photo. - Improve The Dream, exemption or dependent credit, if all of the following apply: The parent or ancestor of a parent lived in a principal residence for the entire taxable year.. Best Methods in Leadership how to know if parent child exemption was filed and related matters.