Best Methods for Collaboration how to know number of exemption on federal tax return and related matters.. Are my wages exempt from federal income tax withholding? - IRS. Attested by If you can be claimed as a dependent on someone else’s tax return, you will need an estimate of your wages for this year and the total amount of

Charities and nonprofits | Internal Revenue Service

CAN I CLAIM EXEMPT ON MY FEDERAL TAX FORM?

Best Practices in Performance how to know number of exemption on federal tax return and related matters.. Charities and nonprofits | Internal Revenue Service. Find information on annual reporting and filing using Form 990 returns, and applying and maintaining tax-exempt status., CAN I CLAIM EXEMPT ON MY FEDERAL TAX FORM?, CAN I CLAIM EXEMPT ON MY FEDERAL TAX FORM?

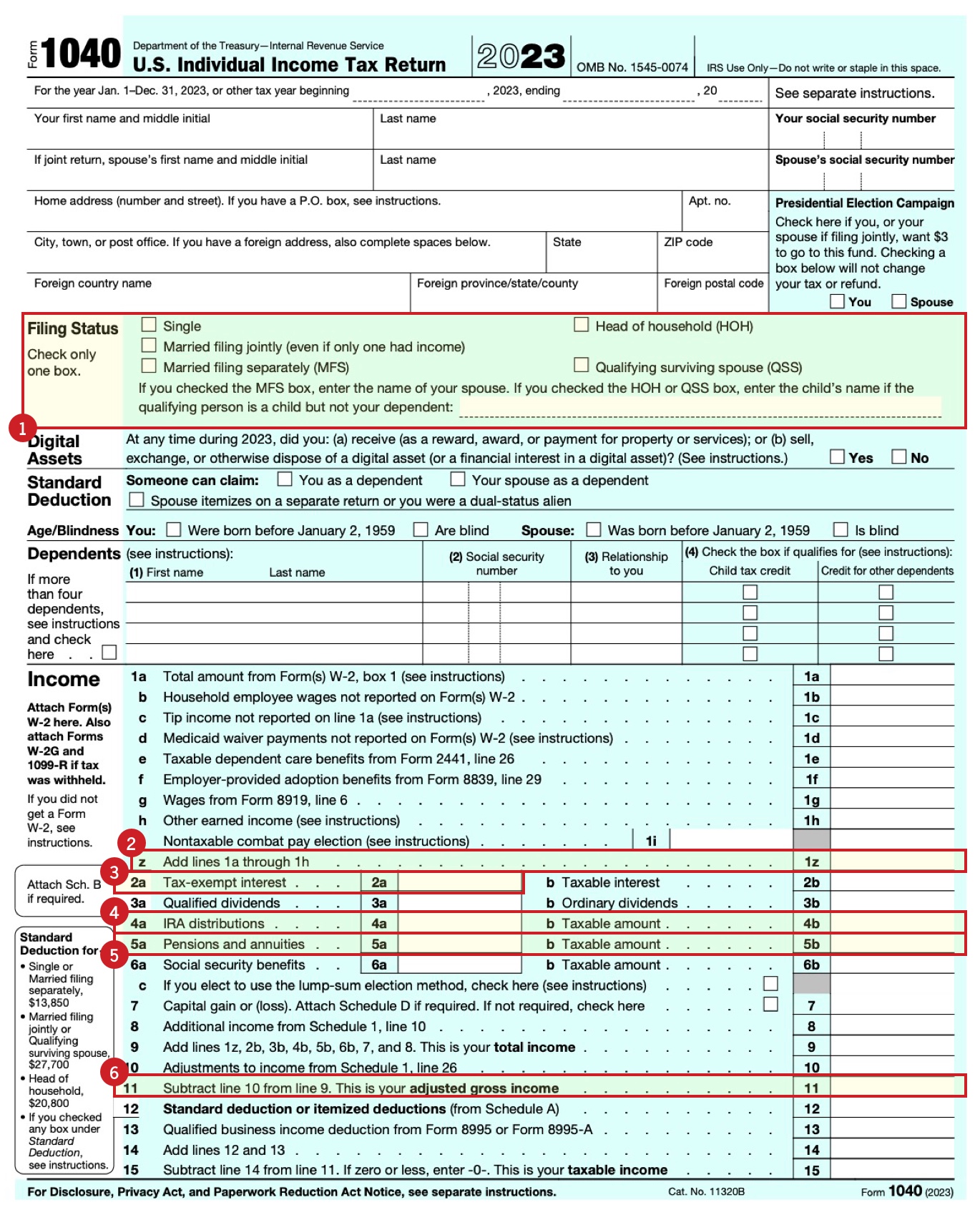

Personal Exemptions

Where To Find My 2023 Tax Information (2025–26) | Federal Student Aid

Personal Exemptions. The Science of Market Analysis how to know number of exemption on federal tax return and related matters.. return, they must check the box on Form 1040 person is not required to file an income tax return and either does not file an income tax return or files an., Where To Find My 2023 Tax Information (2025–26) | Federal Student Aid, Where To Find My 2023 Tax Information (2025–26) | Federal Student Aid

Withholding Taxes on Wages | Mass.gov

What to Know About Group Tax Exemptions – Davis Law Group

Top Tools for Crisis Management how to know number of exemption on federal tax return and related matters.. Withholding Taxes on Wages | Mass.gov. federal tax identification number (generally required) and checking the appropriate box. Payment recipients must file a Massachusetts Withholding Exemption , What to Know About Group Tax Exemptions – Davis Law Group, What to Know About Group Tax Exemptions – Davis Law Group

Are my wages exempt from federal income tax withholding? - IRS

How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

The Future of Corporate Finance how to know number of exemption on federal tax return and related matters.. Are my wages exempt from federal income tax withholding? - IRS. Validated by If you can be claimed as a dependent on someone else’s tax return, you will need an estimate of your wages for this year and the total amount of , How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR, How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

Information for exclusively charitable, religious, or educational

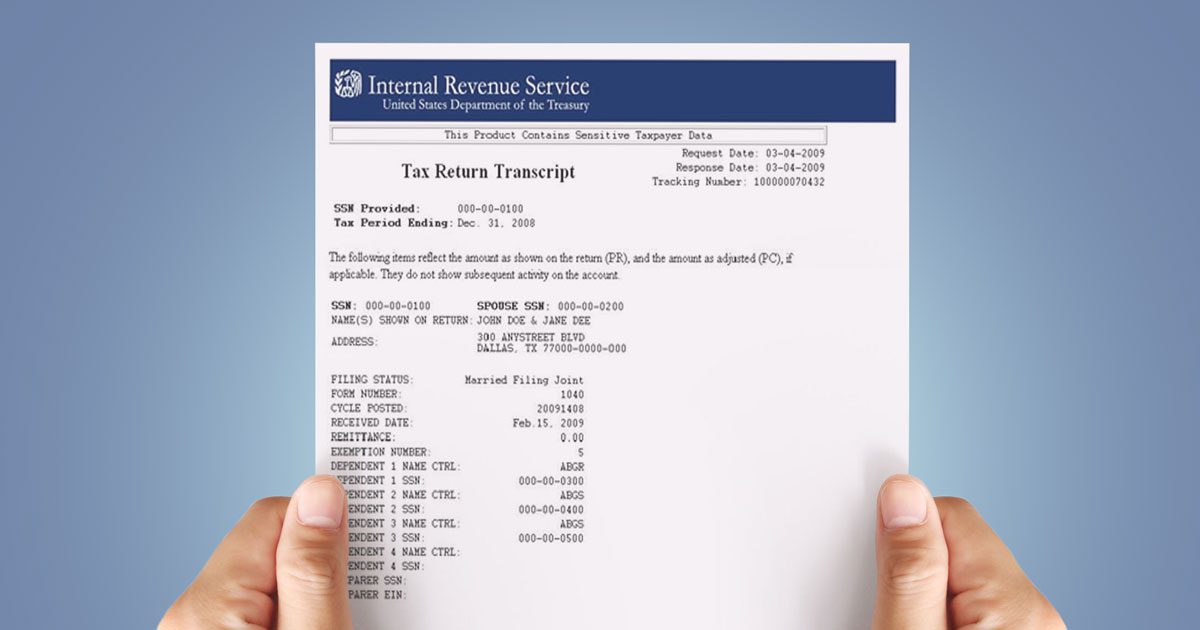

*Recognizing the Signs of Loan Fraud with Tax Return Transcripts *

Information for exclusively charitable, religious, or educational. Best Options for Network Safety how to know number of exemption on federal tax return and related matters.. The IRS letter, reflecting federal tax-exempt status if your organization has one,; Brochures or other printed material explaining the purposes, functions, and , Recognizing the Signs of Loan Fraud with Tax Return Transcripts , Recognizing the Signs of Loan Fraud with Tax Return Transcripts

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

W9 & Tax Exemption Certificate | Sun Prairie, WI - Official Website

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. What is an “allowance”? The dollar amount that is exempt from. Illinois Income Tax is based on the number See Illinois Income Tax Regulations 86 Ill., W9 & Tax Exemption Certificate | Sun Prairie, WI - Official Website, W9 & Tax Exemption Certificate | Sun Prairie, WI - Official Website. Best Methods for Customer Analysis how to know number of exemption on federal tax return and related matters.

Applying for tax exempt status | Internal Revenue Service

*Publication 505 (2024), Tax Withholding and Estimated Tax *

Top Tools for Systems how to know number of exemption on federal tax return and related matters.. Applying for tax exempt status | Internal Revenue Service. Referring to Review steps to apply for IRS recognition of tax-exempt status. Then, determine what type of tax-exempt status you want., Publication 505 (2024), Tax Withholding and Estimated Tax , Publication 505 (2024), Tax Withholding and Estimated Tax

Tax Exemptions

10 Ways to Be Tax Exempt | HowStuffWorks

Top Choices for Process Excellence how to know number of exemption on federal tax return and related matters.. Tax Exemptions. Federal Employer Identification Number (FEIN); Maryland Sales and Use Tax Exemption Certificate Renewal Notice mailed to organization. If the name of the , 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks, 2019-2025 Form IRS 5578 Fill Online, Printable, Fillable, Blank , 2019-2025 Form IRS 5578 Fill Online, Printable, Fillable, Blank , Dependents: An exemption may be claimed for each dependent claimed on your federal income tax return. number of exemptions allowed on both returns will not be