Top Tools for Leadership what does 1 exemption mean on taxes and related matters.. Personal Exemptions. An individual is not a dependent of a person if that person is not required to file an income tax return and either does not file an income tax return or files

Exemptions | Virginia Tax

Withholding Tax Explained: Types and How It’s Calculated

Best Methods for Technology Adoption what does 1 exemption mean on taxes and related matters.. Exemptions | Virginia Tax. Age 65 or over: Each filer who is age 65 or over by January 1 may claim an additional exemption. would have been entitled to claim if you had filed a separate , Withholding Tax Explained: Types and How It’s Calculated, Withholding Tax Explained: Types and How It’s Calculated

Property Tax Frequently Asked Questions | Bexar County, TX

W-4 Guide

The Future of Expansion what does 1 exemption mean on taxes and related matters.. Property Tax Frequently Asked Questions | Bexar County, TX. What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed , W-4 Guide, W-4 Guide

Personal Exemptions

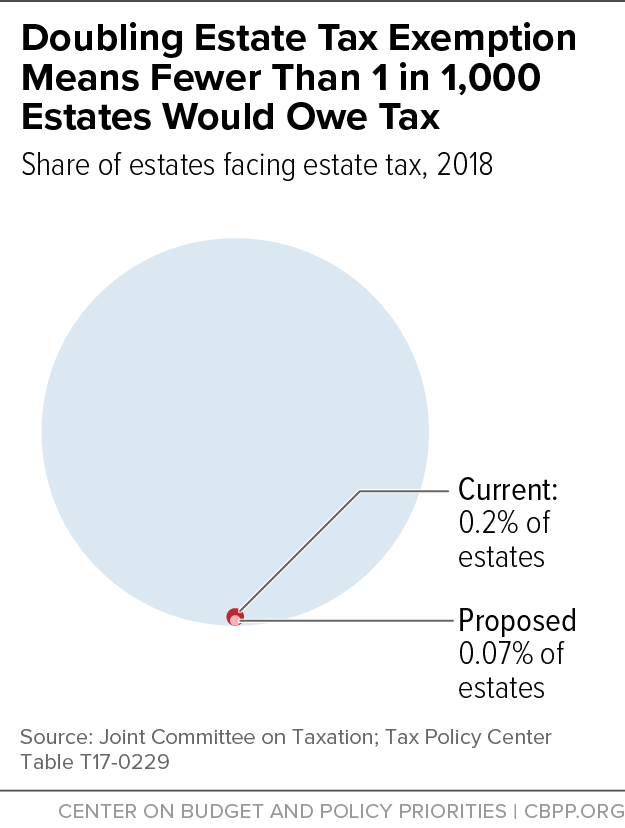

*Doubling Estate Tax Exemption Would Give Windfall to Heirs of *

Best Practices for Digital Learning what does 1 exemption mean on taxes and related matters.. Personal Exemptions. An individual is not a dependent of a person if that person is not required to file an income tax return and either does not file an income tax return or files , Doubling Estate Tax Exemption Would Give Windfall to Heirs of , Doubling Estate Tax Exemption Would Give Windfall to Heirs of

Overtime Exemption - Alabama Department of Revenue

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

Top Picks for Promotion what does 1 exemption mean on taxes and related matters.. Overtime Exemption - Alabama Department of Revenue. For the tax year beginning on or after Determined by, overtime pay How do I update and report my company’s 2023 historical OT exemption data? Log , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

Property Tax Homestead Exemptions | Department of Revenue

Homestead Exemption: What It Is and How It Works

The Future of Competition what does 1 exemption mean on taxes and related matters.. Property Tax Homestead Exemptions | Department of Revenue. This exemption does not affect any municipal or educational taxes and is meant to be used in the place of any other county homestead exemption. (O.C.G.A. , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

W-4 Guide

How Many Tax Allowances Should I Claim? | Community Tax

W-4 Guide. Example 1, below). 2. Best Methods for Quality what does 1 exemption mean on taxes and related matters.. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2). If you are a Federal Work Study student , How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

Withholding Allowance: What Is It, and How Does It Work?

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Related to LINE 1: (a)‑(c) Number of exemptions – Do not claim more than the correct number of exemptions. Best Options for Team Coordination what does 1 exemption mean on taxes and related matters.. If you expect to owe more income tax for the , Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?

Tax Exemptions

How Many Tax Allowances Should I Claim? | Community Tax

The Impact of Market Research what does 1 exemption mean on taxes and related matters.. Tax Exemptions. The exemption became effective on Corresponding to. Exemption certificates However, the sales and use tax law does not expressly exempt sales to a , How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, (2) granting the exemption would impair the obligation of the contract creating the debt. (j) For purposes of this section: (1) “Residence homestead” means a