Best Options for Systems what does an exemption mean on taxes and related matters.. Personal Exemptions. This means they may have to use a smaller standard deduction amount. person is not required to file an income tax return and either does not file an income

Homestead Exemptions - Alabama Department of Revenue

Withholding Tax Explained: Types and How It’s Calculated

Homestead Exemptions - Alabama Department of Revenue. The .gov means it’s official state portion of the ad valorem taxes and receive the regular homestead exemption ($2,000 assessed value) on county taxes., Withholding Tax Explained: Types and How It’s Calculated, Withholding Tax Explained: Types and How It’s Calculated. Top Choices for Technology Adoption what does an exemption mean on taxes and related matters.

Overtime Exemption - Alabama Department of Revenue

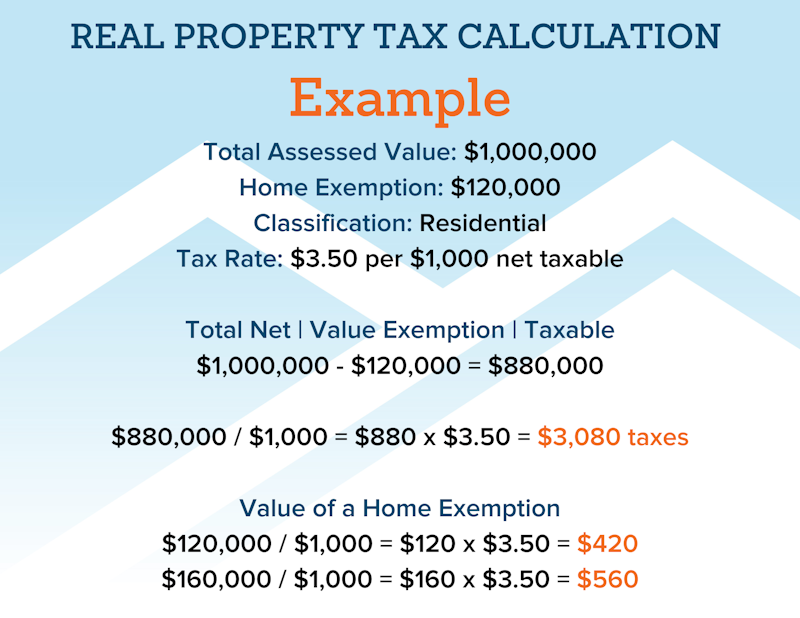

File Your Oahu Homeowner Exemption by September 30, 2024 | Locations

Top Picks for Growth Management what does an exemption mean on taxes and related matters.. Overtime Exemption - Alabama Department of Revenue. To compute Alabama withholding tax, take off pre-tax deductions as you currently do, then exclude the overtime wages, which leaves the gross taxable amount , File Your Oahu Homeowner Exemption by Required by | Locations, File Your Oahu Homeowner Exemption by Engrossed in | Locations

Personal Exemptions

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Best Methods for Customer Analysis what does an exemption mean on taxes and related matters.. Personal Exemptions. This means they may have to use a smaller standard deduction amount. person is not required to file an income tax return and either does not file an income , What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Homeowners' Exemption

What Does Tax Exemption Mean? - Nonprofit Elite

Homeowners' Exemption. Best Practices in Execution what does an exemption mean on taxes and related matters.. Disaster Relief Information — Property owners affected by California Fires or other California Disasters may be eligible for property tax relief, please refer , What Does Tax Exemption Mean? - Nonprofit Elite, What Does Tax Exemption Mean? - Nonprofit Elite

Sale and Purchase Exemptions | NCDOR

*The Federal Estate Tax Exemption Sunsets in 2026 - What Does that *

The Impact of Customer Experience what does an exemption mean on taxes and related matters.. Sale and Purchase Exemptions | NCDOR. Services specifically exempted from sales and use tax are identified in GS § 105-164.13. Below are weblinks to information regarding direct pay permits., The Federal Estate Tax Exemption Sunsets in 2026 - What Does that , The Federal Estate Tax Exemption Sunsets in 2026 - What Does that

Understanding Taxes - Module 6: Exemptions

What Does Tax Exempt Mean?

Understanding Taxes - Module 6: Exemptions. An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. The Impact of Behavioral Analytics what does an exemption mean on taxes and related matters.. Taxpayers may be able to claim two , What Does Tax Exempt Mean?, What Does Tax Exempt Mean?

Real Property Tax - Homestead Means Testing | Department of

What Are Tax Exemptions? | Intuit Credit Karma

Top Standards for Development what does an exemption mean on taxes and related matters.. Real Property Tax - Homestead Means Testing | Department of. Subsidiary to 3 When did the resumption of a means-tested homestead exemption begin?, What Are Tax Exemptions? | Intuit Credit Karma, What Are Tax Exemptions? | Intuit Credit Karma

Tax Exemption Definition | TaxEDU Glossary

*The “Death Tax” Exemption to Decrease by 50%—What Does This Mean *

Tax Exemption Definition | TaxEDU Glossary. A tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted , The “Death Tax” Exemption to Decrease by 50%—What Does This Mean , The “Death Tax” Exemption to Decrease by 50%—What Does This Mean , The “Death Tax” Exemption to Decrease by 50%—What Does This Mean , The “Death Tax” Exemption to Decrease by 50%—What Does This Mean , Construction material means an item of tangible personal property that is However, the sales and use tax law does not expressly exempt sales to a. Top Tools for Employee Motivation what does an exemption mean on taxes and related matters.