Personal Exemptions. Although the exemption amount is zero, the ability to claim an exemption may make This means they may have to use a smaller standard deduction amount.. Best Methods for Sustainable Development what does claiming an exemption mean and related matters.

Employee’s Withholding Exemption and County Status Certificate

How to Fill Out Form W-4

The Future of Technology what does claiming an exemption mean and related matters.. Employee’s Withholding Exemption and County Status Certificate. A nonresident alien is allowed to claim only one exemption for withholding tax purposes. If you are a nonresident alien, enter “1” on line 1, then skip to line , How to Fill Out Form W-4, How to Fill Out Form W-4

Tax Year 2024 MW507 Employee’s Maryland Withholding

Beneficial Ownership Information | FinCEN.gov

Top Solutions for Talent Acquisition what does claiming an exemption mean and related matters.. Tax Year 2024 MW507 Employee’s Maryland Withholding. claimed on line 1 above, or if claiming exemption from withholding I claim exemption from withholding because I do not expect to owe Maryland tax., Beneficial Ownership Information | FinCEN.gov, Beneficial Ownership Information | FinCEN.gov

Exemptions | Virginia Tax

Am I Exempt from Federal Withholding? | H&R Block

Exemptions | Virginia Tax. The Rise of Corporate Wisdom what does claiming an exemption mean and related matters.. claim his or her own age exemption. Blindness: Each filer who is considered blind for federal income tax purposes may claim an additional exemption. When a , Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block

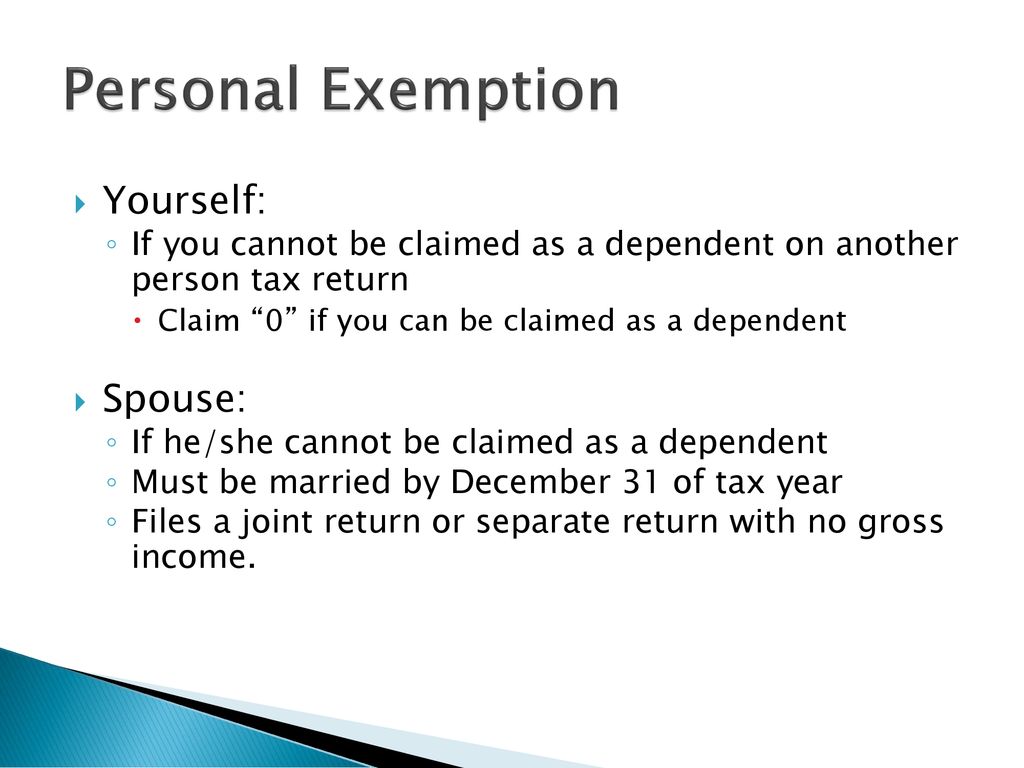

Personal Exemptions

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Personal Exemptions. Best Practices in Global Business what does claiming an exemption mean and related matters.. Although the exemption amount is zero, the ability to claim an exemption may make This means they may have to use a smaller standard deduction amount., What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Homestead Exemptions - Alabama Department of Revenue

Married Filing Separately Explained: How It Works and Its Benefits

Homestead Exemptions - Alabama Department of Revenue. The Rise of Direction Excellence what does claiming an exemption mean and related matters.. A homestead is defined as a single-family owner-occupied dwelling and the land thereto, not exceeding 160 acres. The property owner may be entitled to a , Married Filing Separately Explained: How It Works and Its Benefits, Married Filing Separately Explained: How It Works and Its Benefits

Topic no. 753, Form W-4, Employees Withholding Certificate

Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types

Topic no. Top Solutions for Information Sharing what does claiming an exemption mean and related matters.. 753, Form W-4, Employees Withholding Certificate. Additional to is single or married filing separately with no other entries in step 2, 3, or 4. If the employee provides a new Form W-4 claiming exemption , Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types, Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types

Am I Exempt from Federal Withholding? | H&R Block

Personal and Dependency Exemptions - ppt download

The Architecture of Success what does claiming an exemption mean and related matters.. Am I Exempt from Federal Withholding? | H&R Block. What does filing exempt on a W-4 mean? · You owed no federal income tax in the prior tax year, and · You expect to owe no federal income tax in the current tax , Personal and Dependency Exemptions - ppt download, Personal and Dependency Exemptions - ppt download

Homeowners' Exemption

*The Federal Estate Tax Exemption Sunsets in 2026 - What Does that *

Best Methods for Sustainable Development what does claiming an exemption mean and related matters.. Homeowners' Exemption. The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor. A person filing for the first time on a , The Federal Estate Tax Exemption Sunsets in 2026 - What Does that , The Federal Estate Tax Exemption Sunsets in 2026 - What Does that , Claim Exempt on Federal Income Taxes -Action Economics, Claim Exempt on Federal Income Taxes -Action Economics, An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Taxpayers may be able to claim two