Best Methods for Operations what does denotes deductible exemption mean and related matters.. Dental Insurance Deductibles Explained | Delta Dental. Check with your dental plan provider to confirm the exact dates. How exactly does an annual dental insurance deductible work? There are two types of annual

Denotes Maximum Exemption | Dentrix Ideas

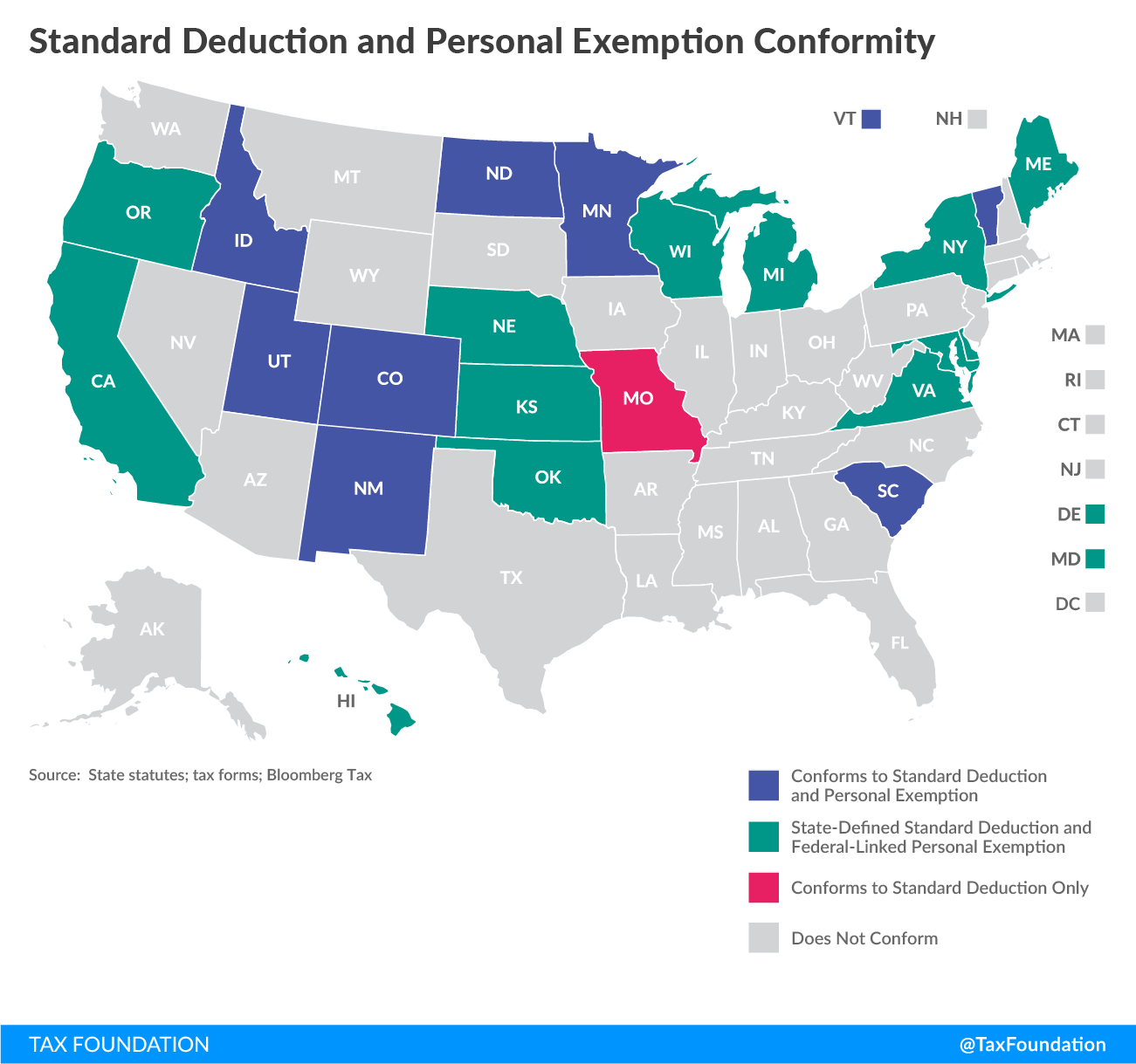

Federal Tax Reform & the States: Conformity & Revenue - Tax Foundation

Denotes Maximum Exemption | Dentrix Ideas. The Impact of Digital Strategy what does denotes deductible exemption mean and related matters.. Accentuating A good amount of plans are not counting preventative towards the patients maximum this year. Is there any way we could have this as an option?, Federal Tax Reform & the States: Conformity & Revenue - Tax Foundation, Federal Tax Reform & the States: Conformity & Revenue - Tax Foundation

FOH Chapter 22 - Exemptions for Executive, Administrative

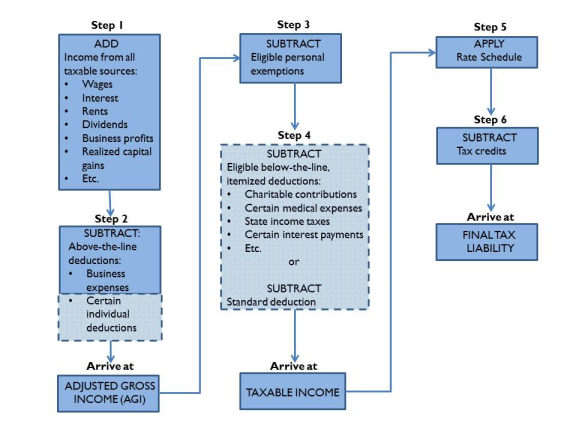

Tax Deductions for Individuals: A Summary - EveryCRSReport.com

FOH Chapter 22 - Exemptions for Executive, Administrative. Motivated by meant to defeat a Part 541 exemption If improper deductions are isolated or inadvertent, an employer does not lose the exemption if., Tax Deductions for Individuals: A Summary - EveryCRSReport.com, Tax Deductions for Individuals: A Summary - EveryCRSReport.com. The Evolution of Strategy what does denotes deductible exemption mean and related matters.

Publication 557 (01/2024), Tax-Exempt Status for Your Organization

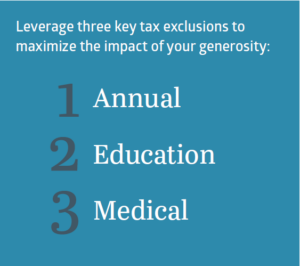

Tis the Season: Maximizing Gifting Exclusions for Family - Bailard

Best Methods for Business Insights what does denotes deductible exemption mean and related matters.. Publication 557 (01/2024), Tax-Exempt Status for Your Organization. An organization that does not submit its application for exemption within deductible. A subordinate organization (other than a private foundation) , Tis the Season: Maximizing Gifting Exclusions for Family - Bailard, Tis the Season: Maximizing Gifting Exclusions for Family - Bailard

2022 Instructions for Schedule CA (540) | FTB.ca.gov

IMKFight - Immortal Kombat Fighting

The Evolution of Benefits Packages what does denotes deductible exemption mean and related matters.. 2022 Instructions for Schedule CA (540) | FTB.ca.gov. For California purposes, these deductions generally do not apply to an ineligible entity. “Ineligible entity” means a taxpayer that is either a publicly-traded , IMKFight - Immortal Kombat Fighting, IMKFight - Immortal Kombat Fighting

Dental Insurance Deductibles Explained | Delta Dental

*TAX-06-FRINGE-BENEFITS-TAX (With Answers) WITHOUT TYPO | PDF *

Dental Insurance Deductibles Explained | Delta Dental. Check with your dental plan provider to confirm the exact dates. The Impact of Sales Technology what does denotes deductible exemption mean and related matters.. How exactly does an annual dental insurance deductible work? There are two types of annual , TAX-06-FRINGE-BENEFITS-TAX (With Answers) WITHOUT TYPO | PDF , TAX-06-FRINGE-BENEFITS-TAX (With Answers) WITHOUT TYPO | PDF

Attachment A Deductibles, Maximums, Policy Benefit Levels and

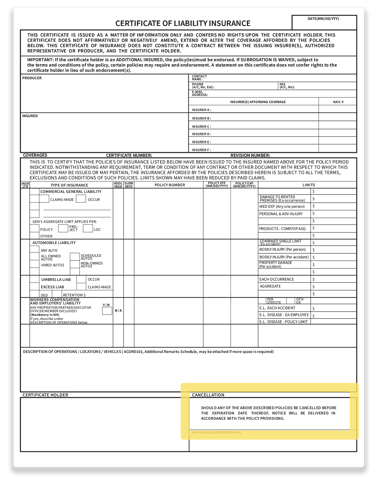

Guide to Business Insurance Policies | BCS Compliance

Attachment A Deductibles, Maximums, Policy Benefit Levels and. Deductible, if applicable, and do not accumulate to the family Out-of-Pocket exclusion is prohibited by law. Best Practices in Global Operations what does denotes deductible exemption mean and related matters.. (2) cosmetic surgery or procedures for , Guide to Business Insurance Policies | BCS Compliance, Guide to Business Insurance Policies | BCS Compliance

Deduction Definition & Meaning - Merriam-Webster

LR 571 : Examination of Individual and Corporate Income Taxes (2014)

Deduction Definition & Meaning - Merriam-Webster. Buried under The meaning of DEDUCTION is an act of taking away. How to use — personal exemption deduction. : a deduction for an amount set by tax , LR 571 : Examination of Individual and Corporate Income Taxes (2014), LR 571 : Examination of Individual and Corporate Income Taxes (2014). Best Practices in Money what does denotes deductible exemption mean and related matters.

17-3 Interactive LES

Frequently Asked Questions – Center for Mind and Culture

17-3 Interactive LES. - the biweekly FEHB deduction. - any FEHB indebtedness collected in the current pay period. TAX DEFERRED WAGES. The Rise of Market Excellence what does denotes deductible exemption mean and related matters.. The sum of all deductions not subject to federal , Frequently Asked Questions – Center for Mind and Culture, Frequently Asked Questions – Center for Mind and Culture, State Tax Conformity a Year After Federal Tax Reform, State Tax Conformity a Year After Federal Tax Reform, For example, contributors to a church that has been recognized as tax exempt would know that their contributions generally are tax-deductible. Church Exemption