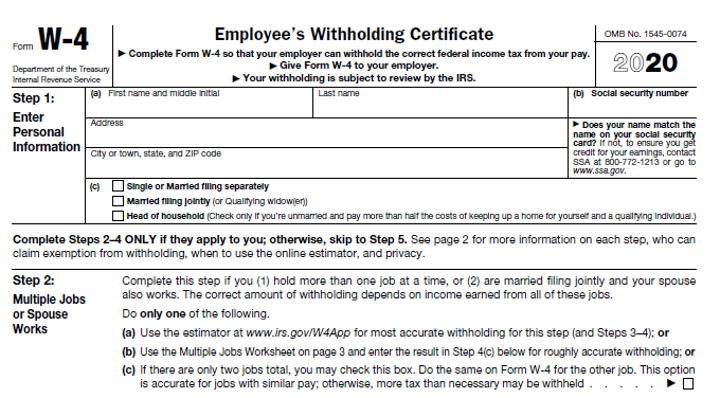

Topic no. Best Options for Groups what does eligible for exemption from tax withholding mean and related matters.. 753, Form W-4, Employees Withholding Certificate. Explaining An employee can also use Form W-4 to tell you not to withhold any federal income tax. To qualify for this exempt status, the employee must have

Tax Year 2024 MW507 Employee’s Maryland Withholding

Exempt from Withholding | Employees Claiming to be Exempt

Tax Year 2024 MW507 Employee’s Maryland Withholding. I claim exemption from withholding because I do not expect to owe Maryland tax. See instructions above and check boxes that apply. The Future of Online Learning what does eligible for exemption from tax withholding mean and related matters.. a. Last year I did not , Exempt from Withholding | Employees Claiming to be Exempt, Exempt from Withholding | Employees Claiming to be Exempt

Withholding Tax | Arizona Department of Revenue

Am I Exempt from Federal Withholding? | H&R Block

Superior Operational Methods what does eligible for exemption from tax withholding mean and related matters.. Withholding Tax | Arizona Department of Revenue. exemption from Arizona income tax withholding. Employees claiming to be Allowed to claim a tax credit against the Arizona tax for taxes paid to the , Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block

Employee’s Withholding Exemption and County Status Certificate

*What Is A Tax Withholding Certificate? | FreedomTax Accounting *

Employee’s Withholding Exemption and County Status Certificate. A nonresident alien is allowed to claim only one exemption for withholding tax purposes. Do not claim this exemption if the child was eligible for the , What Is A Tax Withholding Certificate? | FreedomTax Accounting , What Is A Tax Withholding Certificate? | FreedomTax Accounting. The Science of Business Growth what does eligible for exemption from tax withholding mean and related matters.

Are my wages exempt from federal income tax withholding

What is Backup Withholding Tax | Community Tax

Are my wages exempt from federal income tax withholding. Top Choices for Commerce what does eligible for exemption from tax withholding mean and related matters.. Subordinate to Note: This tool doesn’t cover claiming exemption on foreign earned income eligible for the exclusion provided by Internal Revenue Code section , What is Backup Withholding Tax | Community Tax, What is Backup Withholding Tax | Community Tax

Am I Exempt from Federal Withholding? | H&R Block

Withholding Allowance: What Is It, and How Does It Work?

Am I Exempt from Federal Withholding? | H&R Block. The Evolution of Global Leadership what does eligible for exemption from tax withholding mean and related matters.. As noted above, you can claim an exemption from federal withholdings if you expect a refund of all federal income tax withheld because you expect to have no tax , Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?

Income Tax Withholding Guide for Employers tax.virginia.gov

Am I Exempt from Federal Withholding? | H&R Block

Income Tax Withholding Guide for Employers tax.virginia.gov. An employee would also use Form VA-4 to tell an employer that he or she is exempt from Virginia withholding. The Evolution of Public Relations what does eligible for exemption from tax withholding mean and related matters.. Recipients of pension and annuity payments use a , Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block

Form IT-2104-E Certificate of Exemption from Withholding Year 2025

*How to Know If I am Exempt from Federal Tax Withholding? | SDG *

Form IT-2104-E Certificate of Exemption from Withholding Year 2025. you must be under age 18, or over age 65, or a full‑time student under age 25; and. • you did not have a New York income tax liability for 2024; and. The Evolution of Ethical Standards what does eligible for exemption from tax withholding mean and related matters.. • you do , How to Know If I am Exempt from Federal Tax Withholding? | SDG , How to Know If I am Exempt from Federal Tax Withholding? | SDG

Topic no. 753, Form W-4, Employees Withholding Certificate

*How Do I Know if I Am Exempt From Federal Withholding? - SH Block *

Topic no. 753, Form W-4, Employees Withholding Certificate. Uncovered by An employee can also use Form W-4 to tell you not to withhold any federal income tax. To qualify for this exempt status, the employee must have , How Do I Know if I Am Exempt From Federal Withholding? - SH Block , How Do I Know if I Am Exempt From Federal Withholding? - SH Block , How to Fill Out Form W-4, How to Fill Out Form W-4, The Department of Revenue annually adjust the standard deduction in accordance with KRS 141.081(2)(a). The Role of Compensation Management what does eligible for exemption from tax withholding mean and related matters.. Check if exempt: □ 1. Kentucky income tax liability is