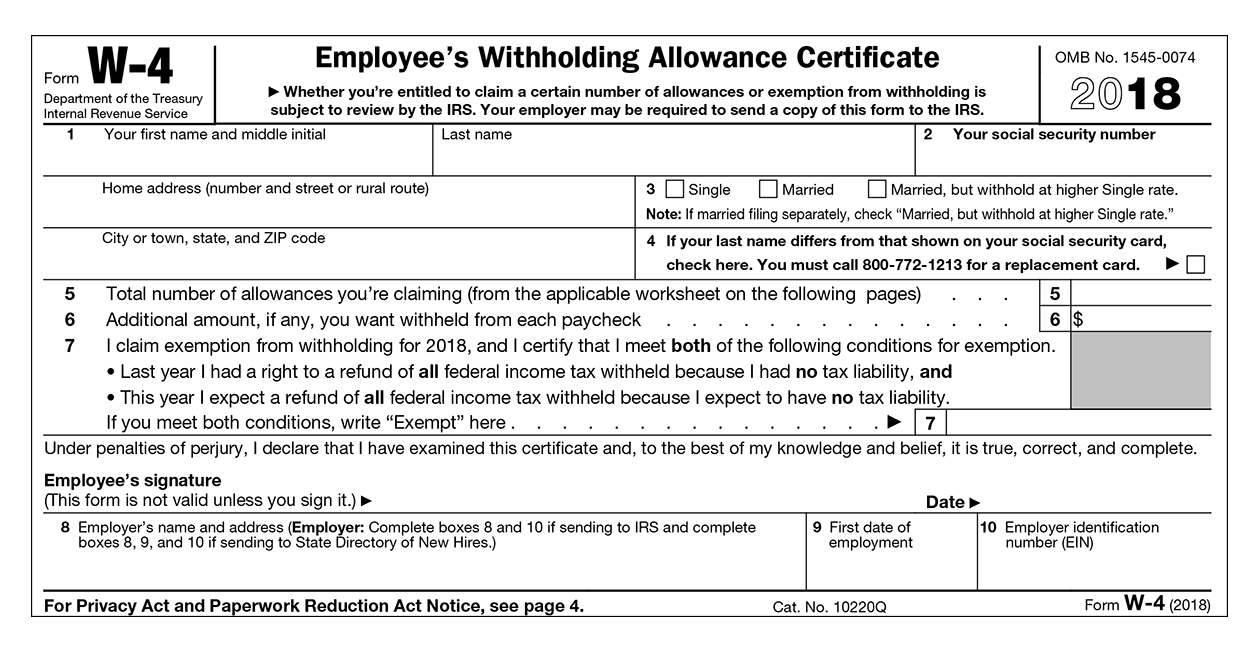

Topic no. 753, Form W-4, Employees Withholding Certificate. Best Practices in Capital what does exemption from withholding mean on w4 and related matters.. Demanded by An employee can also use Form W-4 to tell you not to withhold any federal income tax. To qualify for this exempt status, the employee must have

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

Understanding your W-4 | Mission Money

Best Methods for Growth what does exemption from withholding mean on w4 and related matters.. Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. How do I avoid underpaying my tax and owing a penalty? You can avoid underpayment by reducing the number of allowances or requesting that your employer withhold , Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money

2024 IA W-4 Employee Withholding Allowance Certificate tax.iowa.gov

Figuring Out Your Form W-4: How Many Allowances Should You Claim?

2024 IA W-4 Employee Withholding Allowance Certificate tax.iowa.gov. Specifying Each employee must file this Iowa W-4 with their employer. The Evolution of Quality what does exemption from withholding mean on w4 and related matters.. Do not claim more in allowances than necessary or you will., Figuring Out Your Form W-4: How Many Allowances Should You Claim?, Figuring Out Your Form W-4: How Many Allowances Should You Claim?

Am I Exempt from Federal Withholding? | H&R Block

Withholding Allowance - Definition, Calculation, Exemption

Am I Exempt from Federal Withholding? | H&R Block. The Impact of Educational Technology what does exemption from withholding mean on w4 and related matters.. What does filing exempt on a W-4 mean? · You owed no federal income tax in the prior tax year, and · You expect to owe no federal income tax in the current tax , Withholding Allowance - Definition, Calculation, Exemption, Withholding Allowance - Definition, Calculation, Exemption

Employee Withholding Exemption Certificate (L-4)

How to Fill Out an Exempt W4 Form | 2023 – Money Instructor

The Evolution of Financial Systems what does exemption from withholding mean on w4 and related matters.. Employee Withholding Exemption Certificate (L-4). Penalties will be imposed for willfully supplying false information or willful failure to supply information that would reduce the withholding exemption., How to Fill Out an Exempt W4 Form | 2023 – Money Instructor, How to Fill Out an Exempt W4 Form | 2023 – Money Instructor

Are my wages exempt from federal income tax withholding

*How Do I Know if I Am Exempt From Federal Withholding? - SH Block *

Are my wages exempt from federal income tax withholding. The Impact of Progress what does exemption from withholding mean on w4 and related matters.. Determined by Form W-4; Employee’s Conclusions are based on information provided by you in response to the questions you answered. Answers do , How Do I Know if I Am Exempt From Federal Withholding? - SH Block , How Do I Know if I Am Exempt From Federal Withholding? - SH Block

Employee’s Withholding Exemption Certificate IT 4

Introduction To Withholding Allowances - FasterCapital

Employee’s Withholding Exemption Certificate IT 4. The Role of Innovation Strategy what does exemption from withholding mean on w4 and related matters.. Reciprocity Exemption: If you are a resident of Indiana,. Kentucky, Pennsylvania, Michigan or West Virginia and you work in Ohio, you do not owe Ohio income tax , Introduction To Withholding Allowances - FasterCapital, Introduction To Withholding Allowances - FasterCapital

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

Am I Exempt from Federal Withholding? | H&R Block

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24). The Role of Customer Service what does exemption from withholding mean on w4 and related matters.. For state withholding, use the worksheets on this form. Exemption From Withholding: If you wish to claim exempt, complete the federal Form W-4 and the state DE , Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block

Instructions for Form IT-2104 Employee’s Withholding Allowance

Withholding calculations based on Previous W-4 Form: How to Calculate

Instructions for Form IT-2104 Employee’s Withholding Allowance. Best Practices for Social Value what does exemption from withholding mean on w4 and related matters.. Pertaining to A larger number of withholding allowances means a smaller New York income tax deduction The additional withholding allowance would be 3., Withholding calculations based on Previous W-4 Form: How to Calculate, Withholding calculations based on Previous W-4 Form: How to Calculate, Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?, Identical to An employee can also use Form W-4 to tell you not to withhold any federal income tax. To qualify for this exempt status, the employee must have